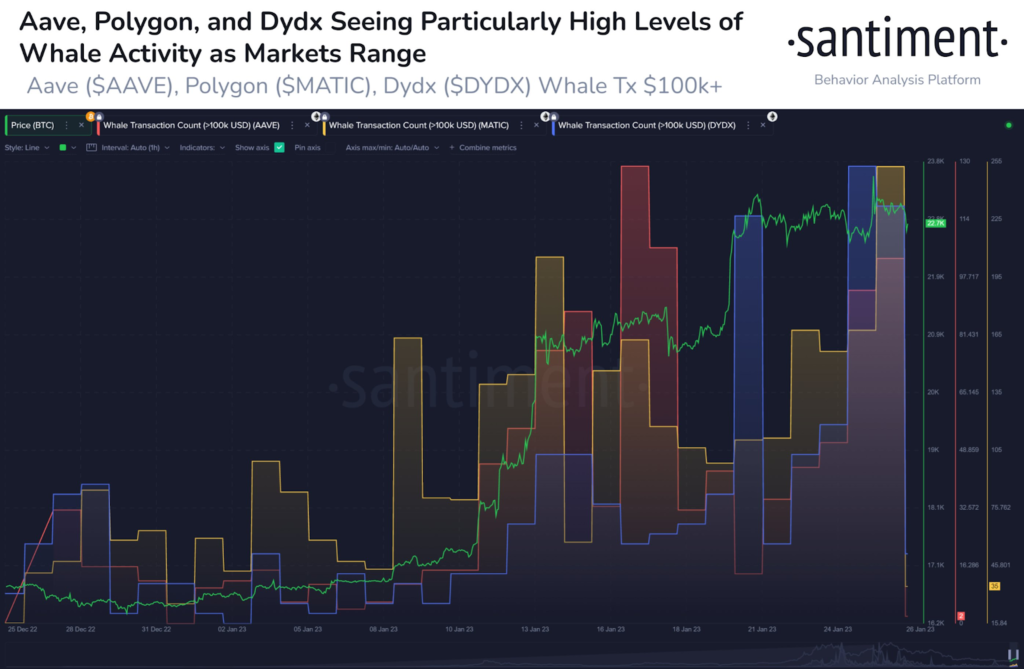

- As per the on-chain analytics firm Santiment, Polygon, Aave and DyDx have all been reassembled with excessive whale exercise just lately.

- The pertinent signal right here is the “whale transaction depend” which computes the whole variety of transfers that whales are doing at the moment.

In reference to these altcoins, the state for a transaction to estimate as one coming from whales is that it should embody a circulation of cash valuing a minimal of $100,000.

When the value of this metric is inflated for any coin, it means whales are creating an enormous variety of transactions of that particular crypto at the moment. This pattern says these immense holders are buying and selling the actual coin on the given length with large activeness.

From that point, whale transactions embody the circulation of enormous scales of capital, a significant variety of them altogether can typically remarkably affect the market. As a consequence, the whale transaction depend is of considerable price and might result in surged volatility within the worth of the crypto into account.

The chart

Now, the given chart right here represents the pattern within the whale transaction depend for these altcoins particularly Polygon, Aave, and DyDx within the final month:

As represented within the graph, Polygon, Aave, and Dydx have all witnessed some pleasing excessive whale exercise during the last month. Within the given length, these altcoins have additionally represented some essential reassembling. As per the info, AAVE has jumped 56%, MATIC 35%, and DYDX 94%.

Satirically, probably the most essential stakes within the transaction depend of whales for these cash emerged when the market was fluctuating between January 13 and January 18. Going by means of this distinctive burst of exercise, the rally recommenced its pitch and altcoins considerably shot of their price.

Prior to now few days, the value of the indicator has once more been on the similar ranges as witnessed on the time of talked about upraised whale exercise interval in the beginning of this month.

On the similar time, excessive whale transaction counts may be declining or optimistic for the value of those cash, the truth that the current sample is as similar as that prior one within the month when excessive exercise from his unit was in actual optimistic, may counsel the chances could also be on the aspect of those altcoins.

In any which case, as Santiment says, “the hyped massive tackle curiosity in these property ought to be analyzed with care.”

from Altcoin – My Blog https://ift.tt/bOSjwnY

via IFTTT

No comments:

Post a Comment