Bitcoin Guidelines – However Not But…

Vitalij Sova/iStock by way of Getty Photos

Observe Not Your Coronary heart on Bitcoin

I’ve not too long ago seen numerous bullish prognoses for Bitcoin (BTC-USD). Whereas my heartstrings pull in that route, my rationale self – as nicely as my studying of the tea leaves – eeehhh I imply technical charts – tells me it simply ain’t so.

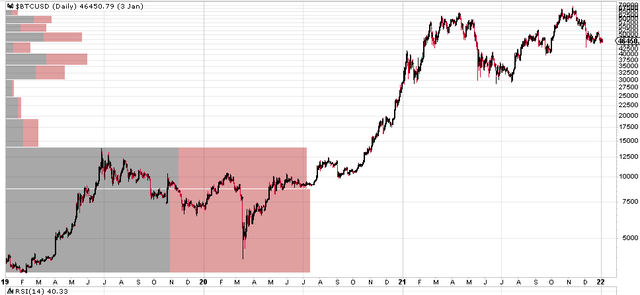

First a little bit of current historical past. Within the midst of Covid despondency, Bitcoin reversed a previous rally and plunged to a low of $3948 in March 2020.

Bitcoin Covid lows (stockcharts.com)

However Covid induced the Federal Reserve to tug out all the stops and interact in large money-printing to leap begin a failing economic system. Bitcoin subsequently soared to unprecedented heights of $68,978 a 1600% acquire in simply 2 years, peaking in November 2021.

Since then, Bitcoin gave again $53,498 {dollars} (78% measured off the excessive), dropping as little as $15,480 in late Nov 2022. Speak about a curler coaster!

Hypothesis is excessive on each side of the talk. Is the ultimate backside in? Is Bitcoin doomed? Will cryptos disappear in a digitally enhanced model of Dutch Tulip Mania?

Let’s use just a little technical evaluation to search out out.

Why Seek the advice of the Charts?

Technical evaluation is both voodoo or the perfect factor since my mom’s peanut butter and jelly sandwich. Or possibly a mixture of each. Over the past 15 years of buying and selling, I’ve gone from full sceptic, to curious dabbler, to ardent follower.

Backside line, I consider an investor ignores technical charts at their very own threat. For all of their hocus-pocus, line-drawing complexity, technical charts mirror the psychology of crowd habits. Crowd habits is the primary issue affecting costs within the quick to medium time period. Very long run actuality of income and losses, service and product high quality do intrude and form inventory costs. However that may take a loooonnnnng time.

Behold My Crystal Ball

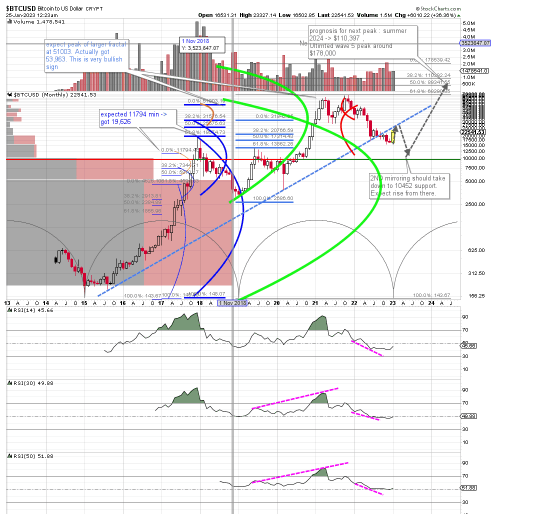

Check out this chart, which exhibits a long run chart of Bitcoin utilizing weekly candles extending from 2015 to the current day.

Bitcoin technical evaluation and prognosis Jan 2023 (stockcharts.com)

Sorry about all of the squiggly strains, and the confusion of colours. I will have you ever deal with the inexperienced ellipses first. These characterize the waves of Elliot wave evaluation. Utilizing Fibonacci calculations of the smaller fractal waves inside that bigger inexperienced wave, I had anticipated Bitcoin to max out at $51,003. As an alternative, Bitcoin peaked at $53,963.

When this overshooting occurs, I’ve seen it is normally fairly bullish for the long run prognosis of the underlying fairness. Let’s name that time 1 for the Bull case.

However first you have to anticipate a retracement of at the very least 38.2%. Nicely we have already had greater than that. In reality, we have seen a drop of greater than 62% ( reached at $25,552) of your entire rise for the reason that 2015 lows.

Wait, however that is a degree for the bearish case, most of the time a drop of greater than 62% is an indication that the inventory needs to retrace 100%. That might imply a drop all the best way to $155!

If that occurs to Bitcoin, IMHO, put a fork in it. It is lifeless. However I do not assume that is what the charts are saying.

RSI To The Rescue

Have a look at the 30 and 50 interval RSI slopes drawn throughout the highs that correspond to cost highs. These are drawn with pink strains. The hint of the highs is convergently pointing upwards together with the value highs. These inform me that this retracement of Bitcoin shall be extreme, however is not going to eclipse the unique rise.

But additionally take a look at the slope of the lows in pink. They’re nonetheless pointed down. That normally means the reversal of development from right down to up isn’t over but. Extra ache is to observe over the following weeks.

When Bitcoin is able to actually backside, we’ll seemingly see the slopes of the lows being positively sloped.

The place do I anticipate that to occur? Nicely proper across the $10,400 degree, give or take. That represents one Fibonacci 168% projection down from the prior (pink) wave traced down from October 2021 to January 2022. This mirroring impact happens about 80% of the time. It is a minimal, not a most worth.

Nothing prevents the mirroring wave from transferring decrease, technically talking. So why $10,400? As a result of that is the place there may be lots of help fashioned over a number of pivots factors over a number of years backed by excessive ranges of shopping for and promoting quantity.

What is the Backside Line?

Misplaced you already? Sorry for the complexity. Let me simplify. Take a look at the traced gray arrows. That is what I see Bitcoin doing. Retesting the ceiling at round $34,000, dropping from there to $10,400, then onwards and upwards to achieve new highs round $110,000 by summer season of 2024.

As talked about in different articles, the best space of uncertainty in my technical evaluation is the time issue. I’ve used time cycles proven within the gray arcs on the backside of the graph. These put the height at round mid-2024. However fairly frankly, I am nowhere close to as assured of that point projection. So please do not wager on it by effective tuning your choice bets on that actual timing.

May I Be Incorrect?

Brief reply: in fact not! Flippancy apart, it has been recognized to occur… So I invite the reader to evaluate a opposite view on these SA pages, which I discover very nicely written: Bitcoin: Vital Restoration Anticipated (Technical Evaluation).

So the place do I differ from Mr. Grummes’ evaluation? I share his long run view that the greenback is threatened by geopolitical occasions. I additionally consider the worldwide financial order is within the midst of a decade lengthy collapse and reset, which is able to finally profit Bitcoin.

I additionally agree together with his assertion that Bitcoin is prone to retrace by at the very least 38%

Even when Bitcoin would take it a bit simpler in 2023, a restoration up in the direction of the 38.2% retracement at round 35,000 USD could be simply conceivable.

However that is the purpose at which our evaluation diverges. I feel that the amount of patrons at $34,000 simply ready to be made entire once more could be very giant. (Simply consider all the spouses hiding their brokerage statements from their wives.) These create large promoting stress.

The Last Shoe Has Not Dropped

A retracement mirroring the 2019 by 62% is definitely potential. However not going for my part. First, 62% of retracements are statistically a lot much less frequent. Second, a hint of the RSI value ranges to their matching costs counsel the $35,000 degree. That would evolve later to level increased, however proper now it doesn’t. Third, large market reversals are normally fashioned slowly over many months in order that Mr. Market can exert most ache out of impatient or inexperienced buyers. That has not but occurred.

Actual world occasions are taking form rapidly, and prone to ship extra ache into crypto markets. The final 2 weeks have seen lots of motion across the impending or potential bankruptcies of Gemini, Genesis and presumably even the Digital Capital Group.

These components guiding these developments are extremely complicated and intensely interwoven, however there may be little doubt that they may have main implications for the crypto area.

Secondly, the US Congress, the Securities Alternate Fee and the Commodities Future Buying and selling Fee are all vying to exert their affect over crypto markets and flex their political muscle mass. Till that lastly crystallizes right into a extra clear reduce regulatory strategy, you may anticipate this to weigh closely on market uncertainties.

So Purchase, Promote Or Maintain?

In case you are a tough core Bitcoinist you may wish to go all in at these costs. What’s a worst-case 50% drop in gentle of a potential and certain 500% acquire in just a few years’ time?

However for many buyers, I might counsel a special strategy. If you happen to like Bitcoin (and I do) make investments a small quantity (maybe 10% of your final stake) so you do not undergo too dangerous from FOMO if I am improper. Contemplate taking income round $35,000.

If costs do drop to the $10k degree, go in with 50% of your stake. Be sure that no matter you put money into, you are snug holding by main volatility. Would you promote if Bitcoin drops to $3000? Then do not make investments. It is not unimaginable.

For many buyers, I feel a greenback price averaging strategy, unfold over a few 2 yr interval makes probably the most sense.

Me? I will use choices. I exploit damaged wing butterfly trades to wager to the draw back and provides myself about 4 months for that to happen.

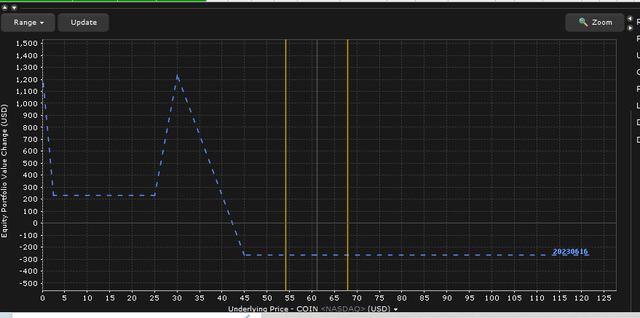

bearish choice commerce on COIN (Interactive brokers choices)

As you see from the graph above, a $267 place might yield a most return of round $900 to $1200. These mirror my present positions. If I am improper and COIN both doesn’t transfer down or takes longer to take action (later than June 16, 2023, I will lose your entire premium paid, or $267. This graph displays the value of the positions taken on the date of expiry in June. If COIN have been to drop precipitously to the $30 value degree, my features not instantly be so giant. This commerce advantages from the passage of time and is basically not affected by choices volatility.

Methods like calendar trades or damaged wing butterfly trades provide very enticing threat reward relationships, wherein you lose solely a fraction of what you acquire if you happen to’re improper however make many occasions your funding if you’re proper.

The largest threat within the methods lies in execution. You will need to enter into the trades utilizing restricted orders and in the fitting sequence to keep away from unintended margin dangers. Please seek the advice of with knowledgeable if you happen to wouldn’t have expertise with this.

from Cryptocurrency – My Blog https://ift.tt/IjOnXBi

via IFTTT

No comments:

Post a Comment