Probably the most common subjects within the digital consensus house (a brand new time period for cryptocurrency 2.0 that I’m beta-testing) is the idea of decentralized autonomous entities. There at the moment are numerous teams quickly getting concerned within the house, together with Bitshares (often known as Invictus Improvements) creating “decentralized autonomous corporations”, BitAngels’ David Johnston with decentralized functions, our personal idea of decentralized autonomous companies which has since remodeled into the way more normal and never essentially monetary “decentralized autonomous organizations” (DAOs); all in all, it’s secure to say that “DAOism” is nicely on its approach to turning into a quasi-cyber-religion. Nevertheless, one of many hidden issues lurking beneath the house is a quite blatant one: nobody even is aware of what all of those invididual phrases imply. What precisely is a decentralized group, what’s the distinction between a corporation and an software, and what even makes one thing autonomous within the first place? Many people have been annoyed by the dearth of coherent terminology right here; as Bitshares’ Daniel Larimer factors out, “everybody thinks a DAC is only a method of IPOing your centralized firm.” The intent of this text will probably be to delve into a few of these ideas, and see if we are able to provide you with not less than the beginnings of a coherent understanding of what all of this stuff really are.

Good contracts

A wise contract is the best type of decentralized automation, and is most simply and precisely outlined as follows: a sensible contract is a mechanism involving digital belongings and two or extra events, the place some or the entire events put belongings in and belongings are routinely redistributed amongst these events in keeping with a components primarily based on sure knowledge that isn’t identified on the time the contract is initiated.

One instance of a sensible contract could be an employment settlement: A needs to pay 500 into the contract, and the funds are locked up. When B finishes the web site, B can ship a message to the contract asking to unlock the funds. If A agrees, the funds are launched. If B decides to not end the web site, B can stop by sending a message to relinquish the funds. If B claims that he completed the web site, however A doesn’t agree, then after a 7-day ready interval it’s as much as decide J to supply a verdict in A or B’s favor.

The important thing property of a sensible contract is straightforward: there’s solely a hard and fast variety of events. The events don’t all must be identified at initialization-time; a promote order, the place A affords to promote 50 models of asset A to anybody who can present 10 models of asset B, can be a sensible contract. Good contracts can run on perpetually; hedging contracts and escrow contracts are good examples there. Nevertheless, good contracts that run on perpetually ought to nonetheless have a hard and fast variety of events (eg. a complete decentralized alternate just isn’t a sensible contract), and contracts that aren’t meant to exist perpetually are good contracts as a result of current for a finite time essentially implies the involvement of a finite variety of events.

Observe that there’s one grey space right here: contracts that are finite on one facet, however infinite on the opposite facet. For instance, if I need to hedge the worth of my digital belongings, I’d need to create a contract the place anybody can freely enter and go away. Therefore, the opposite facet of the contract, the events which are speculating on the asset at 2x leverage, has an unbounded variety of events, however my facet of the contract doesn’t. Right here, I suggest the next divide: if the facet with a bounded variety of events is the facet that intends to obtain a particular service (ie. is a shopper), then it’s a good contract; nevertheless, if the facet with a bounded variety of events is simply in it for revenue (ie. is a producer), then it isn’t.

Autonomous Brokers

Autonomous brokers are on the opposite facet of the automation spectrum; in an autonomous agent, there isn’t any crucial particular human involvement in any respect; that’s to say, whereas a point of human effort may be crucial to construct the {hardware} that the agent runs on, there isn’t any want for any people to exist which are conscious of the agent’s existence. One instance of an autonomous agent that already exists as we speak could be a pc virus; the virus survives by replicating itself from machine to machine with out deliberate human motion, and exists virtually as a organic organism. A extra benign entity could be a decentralized self-replicating cloud computing service; such a system would begin off operating an automatic enterprise on one digital personal server, after which as soon as its earnings enhance it could lease different servers and set up its personal software program on them, including them to its community.

A full autonomous agent, or a full synthetic intelligence, is the dream of science fiction; such an entity would be capable of alter to arbitrary adjustments in circumstances, and even develop to fabricate the {hardware} wanted for its personal sustainability in idea. Between that, and single objective brokers like laptop viruses, is a wide range of potentialities, on a scale which might alternatively be described as intelligence or versatility. For instance, the self-replicating cloud service, in its easiest kind, would solely be capable of lease servers from a particular set of suppliers (eg. Amazon, Microtronix and Namecheap). A extra advanced model, nevertheless, ought to be capable of work out lease a server from any supplier given solely a hyperlink to its web site, after which use any search engine to find new web sites (and, after all, new search engines like google in case Google fails). The following stage from there would contain upgrading its personal software program, maybe utilizing evolutionary algorithms, or with the ability to adapt to new paradigms of server rental (eg. make affords for peculiar customers to put in its software program and earn funds with their desktops), after which the penultimate step consists of with the ability to uncover and enter new industries (the last word step, after all, is generalizing utterly right into a full AI).

Autonomous brokers are among the hardest issues to create, as a result of with a view to achieve success they want to have the ability to navigate in an setting that isn’t simply sophisticated and quickly altering, but in addition hostile. If a webhosting supplier needs to be unscrupulous, they could particularly find all situations of the service, after which exchange them with nodes that cheat in some vogue; an autonomous agent should be capable of detect such dishonest and take away or not less than neutralize dishonest nodes from the system.

Decentralized Functions

A decentralized software is much like a sensible contract, however completely different in two key methods. Initially, a decentralized software has an unbounded variety of members on all sides of the market. Second, a decentralized software needn’t be essentially monetary. Due to this second requirement, decentralized functions are literally among the best issues to put in writing (or not less than, had been the simplest earlier than generalized digital consensus platforms got here alongside). For instance, BitTorrent qualifies as a decentralized software, as do Popcorn Time, BitMessage, Tor and Maidsafe (word that Maidsafe can be itself a platform for different decentralized functions).

Usually, decentralized functions fall into two courses, probably with a considerable grey space between the 2. The primary class is a completely nameless decentralized software. Right here, it doesn’t matter who the nodes are; each participant is actually nameless and the system is made up of a sequence of immediate atomic interactions. BitTorrent and BitMessage are examples of this. The second class is a reputation-based decentralized software, the place the system (or not less than nodes within the system) hold monitor of nodes, and nodes preserve standing within the appliance with a mechanism that’s purely maintained for the aim of making certain belief. Standing shouldn’t be transferable or have de-facto financial worth. Maidsafe is an instance of this. In fact, purity is not possible – even a BitTorrent-like system must have friends preserve reputation-like statistics of different friends for anti-DDoS functions; nevertheless, the function that these statistics play is only within the background and really restricted in scope.

An attention-grabbing grey space between decentralized functions and “one thing else” is functions like Bitcoin and Namecoin; these differ from conventional functions as a result of they create ecosystems and there’s a idea of digital property that has worth contained in the context of this ecosystem, in Bitcoin’s case bitcoins and in Namecoin’s case namecoins and domains. As we’ll see under, my classification of decentralized autonomous organizations touches on such ideas, and it isn’t fairly clear precisely the place they sit.

Decentralized Organizations

Normally, a human group may be outlined as mixture of two issues: a set of property, and a protocol for a set of people, which can or is probably not divided into sure courses with completely different situations for coming into or leaving the set, to work together with one another together with guidelines for underneath what circumstances the people might use sure components of the property. For instance, take into account a easy company operating a sequence of shops. The company has three courses of members: buyers, staff and clients. The membership rule for buyers is that of a fixed-size (or optionally quorum-adjustable measurement) slice of digital property; you purchase some digital property to get in, and also you turn into an investor till you promote your shares. Workers have to be employed by both buyers or different staff particularly licensed by buyers (or different staff licensed by different staff licensed by buyers, and so forth recursively) to take part, and can be fired in the identical method, and clients are an open-membership system the place anybody can freely work together with the shop within the apparent formally sanctioned method for any time. Suppliers, on this mannequin, are equal to staff. A nonprofit charity has a considerably completely different construction, involving donors and members (charity recipients might or is probably not thought of members; the choice view sees the constructive increments within the recipients’ welfare as being the charity’s “product”).

The concept of a decentralized group takes the identical idea of a corporation, and decentralizes it. As a substitute of a hierarchical construction managed by a set of people interacting in individual and controlling property by way of the authorized system, a decentralized group includes a set of people interacting with one another in keeping with a protocol laid out in code, and enforced on the blockchain. A DO might or might not make use of the authorized system for some safety of its bodily property, however even there such utilization is secondary. For instance, one can take the shareholder-owned company above, and transplant it completely on the blockchain; a long-running blockchain-based contract maintains a report of every particular person’s holdings of their shares, and on-blockchain voting would enable the shareholders to pick the positions of the board of administrators and the workers. Good property techniques can be built-in into the blockchain instantly, doubtlessly permitting DOs to regulate automobiles, security deposit bins and buildings.

Decentralized Autonomous Organizations

Right here, we get into what is probably the holy grail, the factor that has the murkiest definition of all: decentralized autonomous organizations, and their company subclass, decentralized autonomous companies (or, extra lately, “corporations”). The perfect of a decentralized autonomous group is simple to explain: it’s an entity that lives on the web and exists autonomously, but in addition closely depends on hiring people to carry out sure duties that the automaton itself can’t do.

Given the above, the essential a part of the definition is definitely to deal with what a DAO just isn’t, and what’s not a DAO and is as a substitute both a DO, a DA or an automatic agent/AI. Initially, let’s take into account DAs. The principle distinction between a DA and a DAO is {that a} DAO has inner capital; that’s, a DAO incorporates some type of inner property that’s beneficial ultimately, and it has the power to make use of that property as a mechanism for rewarding sure actions. BitTorrent has no inner property, and Bitcloud/Maidsafe-like techniques have fame however that fame just isn’t a saleable asset. Bitcoin and Namecoin, however, do. Nevertheless, plain previous DOs even have inner capital, as do autonomous brokers.

Second, we are able to take a look at DOs. The plain distinction between a DO and a DAO, and the one inherent within the language, is the phrase “autonomous”; that’s, in a DO the people are those making the selections, and a DAO is one thing that, in some vogue, makes selections for itself. It is a surprisingly difficult distinction to outline as a result of, as dictatorships are all the time eager to level out, there’s actually no distinction between a sure set of actors making selections instantly and that set of actors controlling the entire info by way of which selections are made. In Bitcoin, a 51% assault between a small variety of mining swimming pools could make the blockchain reverse transactions, and in a hypothetical decentralized autonomous company the suppliers of the information inputs can all collude to make the DAC suppose that sending all of its cash to1FxkfJQLJTXpW6QmxGT6oF43ZH959ns8Cq constitutes paying for 1,000,000 nodes’ value of computing energy for ten years. Nevertheless, there’s clearly a significant distinction between the 2, and so we do have to outline it.

My very own effort at defining the distinction is as follows. DOs and DAOs are each susceptible to collusion assaults, the place (in one of the best case) a majority or (in worse instances) a big proportion of a sure kind of members collude to particularly direct the D*O’s exercise. Nevertheless, the distinction is that this: in a DAO collusion assaults are handled as a bug, whereas in a DO they’re a characteristic. In a democracy, for instance, the entire level is {that a} plurality of members select what they like greatest and that answer will get executed; in Bitcoin’s however, the “default” habits that occurs when everybody acts in keeping with particular person curiosity with none need for a particular final result is the intent, and a 51% assault to favor a particular blockchain is an aberration. This enchantment to social consensus is much like the definition of a authorities: if an area gang begins charging a property tax to all shopowners, it could even get away with it in sure components of the world, however no significant slice of the inhabitants will deal with it as authentic, whereas if a authorities begins doing the identical the general public response will probably be tilted within the different course.

Bitcoin is an attention-grabbing case right here. Normally, it appears to be a lot nearer to a DAO than a DO. Nevertheless, there was one incident in 2013 the place the truth proved to be quite completely different. What occurred was that an distinctive block was (not less than we hope) unintentionally produced, which was handled as legitimate in keeping with the BitcoinQt 0.8 purchasers, however invalid in keeping with the principles of BitcoinQt 0.7. The blockchain forked, with some nodes following the blockchain after this distinctive block (we’ll name this chain B1), and the opposite nodes that noticed that block as invalid engaged on a separate blockchain (which we’ll name B2). Most mining swimming pools had upgraded to BitcoinQt 0.8, in order that they adopted B1, however most customers had been nonetheless on 0.7 and so adopted B2. The mining pool operators got here collectively on IRC chat, and agreed to modify their swimming pools to mining on B2, since that final result could be easier for customers as a result of it could not require them to improve, and after six hours the B2 chain overtook B1 because of this deliberate motion, and B1 fell away. Thus, on this case, there was a deliberate 51% assault which was seen by the group as authentic, making Bitcoin a DO quite than a DAO. Typically, nevertheless, this doesn’t occur, so the easiest way to categorise Bitcoin could be as a DAO with an imperfection in its implementation of autonomy.

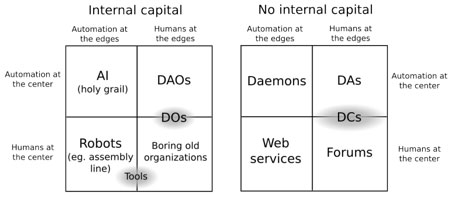

Nevertheless, others usually are not content material to categorise Bitcoin as a DAO, as a result of it isn’t actually good sufficient. Bitcoin doesn’t suppose, it doesn’t exit and “rent” individuals aside from the mining protocol, and it follows easy guidelines the upgrading course of for which is extra DO-like than DAO-like. Individuals with this view would see a DAO as one thing that has a big diploma of autonomous intelligence of its personal. Nevertheless, the difficulty with this view is that there have to be a distinction made between a DAO and an AA/AI. The excellence right here is arguably this: an AI is totally autonomous, whereas a DAO nonetheless requires heavy involvement from people particularly interacting in keeping with a protocol outlined by the DAO with a view to function. We will classify DAOs, DOs (and plain previous Os), AIs and a fourth class, plain previous robots, in keeping with a superb previous quadrant chart, with one other quadrant chart to categorise entities that wouldn’t have inner capital thus altogether making a dice:

DAOs == automation on the middle, people on the edges. Thus, on the entire, it makes most sense to see Bitcoin and Namecoin as DAOs, albeit ones that hardly cross the brink from the DA mark. The opposite essential distinction is inner capital; a DAO with out inner capital is a DA and a corporation with out inner capital is a discussion board; the G8, for instance, would qualify as a discussion board. DCs within the graph above are “decentralized communities”; an instance of that may be one thing like a decentralized Reddit, the place there’s a decentralized platform, however there’s additionally a group round that platform, and it’s considerably ambiguous whether or not the group or the protocol is actually “in cost”.

Decentralized Autonomous Companies

Decentralized autonomous companies/corporations are a smaller subject, as a result of they’re principally a subclass of DAOs, however they’re value mentioning. For the reason that principal exponent of DAC as terminology is Daniel Larimer, we’ll borrow as a definition the purpose that he himself persistently promotes: a DAC pays dividends. That’s, there’s a idea of shares in a DAC that are purchaseable and tradeable in some vogue, and people shares doubtlessly entitle their holders to continuous receipts primarily based on the DAC’s success. A DAO is non-profit; although you may make cash in a DAO, the way in which to try this is by collaborating in its ecosystem and never by offering funding into the DAO itself. Clearly, this distinction is a murky one; all DAOs comprise inner capital that may be owned, and the worth of that inner capital can simply go up because the DAO turns into extra highly effective/common, so a big portion of DAOs are inevitably going to be DAC-like to some extent.

Thus, the excellence is extra of a fluid one and hinges on emphasis: to what extent are dividends the principle level, and to what extent is it about incomes tokens by participation? Additionally, to what extent does the idea of a “share” exist versus easy digital property? For instance, a membership on a nonprofit board just isn’t actually a share, as a result of membership regularly will get granted and confiscated at will, one thing which might be unacceptable for one thing categorized as investable property, and a bitcoin just isn’t a share as a result of a bitcoin doesn’t entitle you to any declare on earnings or decision-making skill contained in the system, whereas a share in a company undoubtedly is a share. Ultimately, maybe the excellence may in the end be the surprisingly obscure level of whether or not or not the revenue mechanism and the consensus mechanism are the identical factor.

The above definitions are nonetheless not shut to finish; there’ll probably be grey areas and holes in them, and precisely what sort of automation a DO will need to have earlier than it turns into a DAO is a really onerous query to reply. Moreover, there’s additionally the query of how all of this stuff must be constructed. An AI, for instance, ought to probably exist as a community of personal servers, every one operating usually proprietary native code, whereas a DO must be absolutely open supply and blockchain-based. Between these two extremes, there’s numerous completely different paradigms to pursue. How a lot of the intelligence must be within the core code? Ought to genetic algorithms be used for updating code, or ought to it’s futarchy or some voting or vetting mechanism primarily based on people? Ought to membership be corporate-style, with sellable and transferable shares, or nonprofit-style, the place members can vote different members out and in? Ought to blockchains be proof of labor, proof of stake, or reputation-based? Ought to DAOs attempt to preserve balances in different currencies, or ought to they solely reward habits by issuing their very own inner token? These are all onerous issues and we have now solely simply begun scratching the floor of them.

from Ethereum – My Blog https://ift.tt/IQv60kw

via IFTTT

No comments:

Post a Comment