The second week of the brand new 12 months has been a heady week for the cash, with Bitcoin, Ethereum, and Solana racking up severe features.

Zooming in nearer, nonetheless, the market’s greatest winners are none apart from liquid staking tokens, additionally known as “liquid staking derivatives” (LSD).

The tokens behind tasks like Lido Finance (up 50.3%) and Rocket Pool (up 23.3%) have completely soared over the previous few days. The explanation? Ethereum devs are rolling up their sleeves forward of a key improve to the community: Shanghai.

Let’s break that down.

Since executing the merge final September, Ethereum has swapped to a proof-of-stake (PoS) consensus mechanism. This implies no extra power-hungry mining machines, and, of their place, so-called validators. Validators and miners successfully do the identical factor, verifying transactions and making certain little on-chain mischief happens.

Nonetheless, validators might be higher distributed than miners because of their decrease price of capital and upkeep. As a substitute of getting to purchase out a multi-million-dollar mining farm someplace in Siberia and hiring a workforce of engineers to maintain these miners operating continuous, all it is advisable change into a validator is 32 Ethereum and the know-how to maintain a single node related to the Ethereum community always.

32 Ethereum, although, continues to be roughly $45,000 at press time, so it’s a hefty sum. And that’s the place these LSD tasks come into play.

They allow you to stake any quantity of Ethereum you may afford. In change, they’ll provide you with one other token (Lido’s staked ETH token is known as “stETH,” for instance) that may be put to make use of elsewhere.

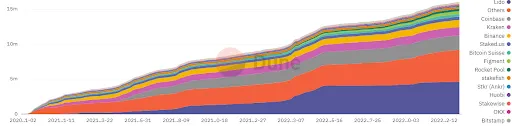

Right this moment, you may earn as a lot as 301% once you stake your stETH in sure components of the ecosystem, in accordance to DeFi Llama. Its large adoption in DeFi is probably going one of many the reason why it’s so fashionable; of this kind of providing (excluding centralized exchange-based equivalents), Lido instructions greater than 88% of the LSD market.

In comparison with centralized platforms like Kraken, Bitcoin Suisse, or companies like Staked.US, Lido nonetheless enjoys 28.9% of the market. Runner-up Kraken has simply 5.57%.

What does this must do with the Shanghai replace?

Just like the merge, Shanghai is one other key improve to Ethereum. It should bundle a number of key enhancements, however a very powerful is the one which can let the above-mentioned stakers lastly withdraw their holdings from the community. At present, that’s not potential (and final 12 months it had a whole lot of people rattled about whether or not it could ever occur).

This meant that stakers who rushed into the Beacon Chain with their 32 Ethereum or a liquid-staking different with a smaller sum have been principally depositing funds with merely a promise that in the future they’d have the ability to withdraw.

Now, although, that promise seems to be approaching actuality (and lowering stakers dangers significantly).

For extra proof of oldsters speeding to check out LSDs, look no additional than Lido overtaking DeFi’s unofficial central financial institution MakerDAO as the most important DeFi protocol.

Keep on prime of crypto information, get each day updates in your inbox.

from Ethereum – My Blog https://ift.tt/GY1NZHj

via IFTTT

No comments:

Post a Comment