No cryptocurrency or token has climbed extra up to now day or week than Aptos, in accordance with CoinGecko.

The Aptos blockchain’s native coin, APT, has greater than doubled its worth up to now seven days and climbed 47%, to $18.46, up to now day alone. Because the begin of the yr, Aptos has soared 350%. Why?

It is tough to pinpoint a exact motive, however knowledge exhibits that about half of APT’s $2 billion quantity up to now day has come from the South Korean gained buying and selling pair on Singapore-based alternate UpBit, in accordance with CoinGecko. On the time of writing, APT was priced at $18.63 on UpBit.

That’s nearly $0.50 greater than it’s promoting for on Binance and on most different exchanges and an indication that a minimum of a portion of the exercise stems from arbitrage trades. Merely put, arbitrage merchants revenue from worth discrepancies. They purchase on the lowest accessible worth and promote on the highest worth they will get.

South Korean exchanges so incessantly record crypto property at larger costs than their international counterparts that the distinction has been dubbed the “Kimchi premium.” Simply final yr, the Seoul Central District Prosecutor’s Workplace opened an investigation into 2 billion Korean gained price of unlawful remittances generated by arbitrage merchants benefiting from it.

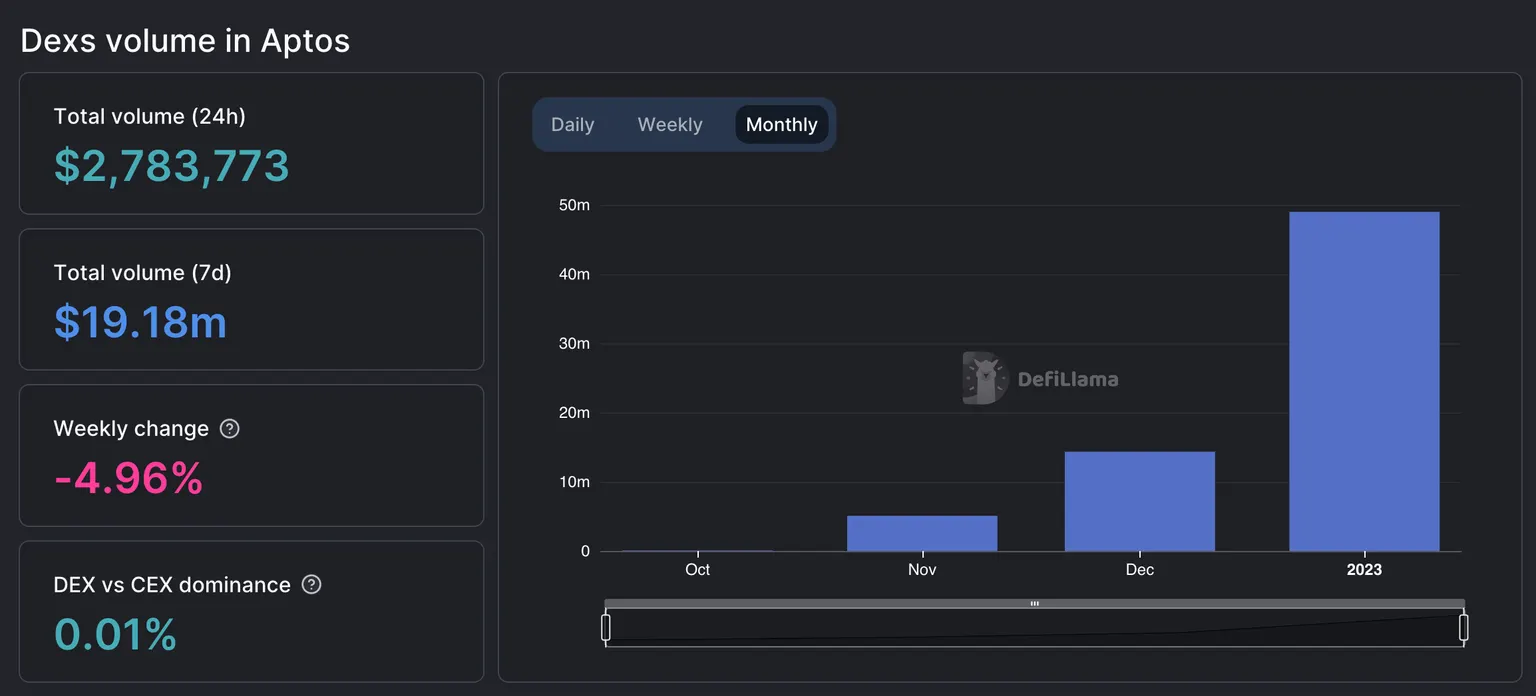

It’s additionally price noting that whereas Aptos continues to be solely the twentieth largest DeFi ecosystem, in accordance with DeFi Llama, it has grown considerably up to now month. The DeFi quantity on Aptos went from $14 million final month to $51 million in January—and the month isn’t even over but.

One other 10% of the APT quantity up to now day has come from Binance’s APT and Binance USD (BUSD) buying and selling pair. Binance, the world’s largest crypto alternate by quantity, additionally just lately launched two APT liquidity swimming pools, which now account for an additional 18% of APT’s buying and selling quantity.

Liquidity swimming pools gas peer-to-peer buying and selling of crypto property. Customers are incentivized to “pool,” or deposit, their tokens to allow them to be swapped with different customers. They’re important for decentralized exchanges, like Uniswap and Curve, to perform. However centralized exchanges like Binance make use of them too.

On January 20, the Binance Liquid Swap platform debuted its APT/Tether and APT/Bitcoin liquidity swimming pools. The platform rewards customers with BNB, the alternate’s utility token, for depositing funds into the swimming pools.

On the time of writing, Binance is promising 92.42% yield on APT/USDT and 99.49% yield on APT/BTC liquidity pool deposits. Of that, customers would obtain 0.71% and 1.07% BNB rewards, respectively, paid each hour.

Aptos has persistently outperformed the market because the begin of the yr. Nevertheless it did get off to a tough begin when its mainnet launched in October.

The challenge acquired lots of backlash for not releasing its tokenomics sooner than it did. The criticism piled on when the blockchain, which promised speeds of as much as 150,000 transactions per second, confirmed speeds of 4 transactions per second after its huge debut.

On the time, Aptos co-founder Mo Shaikh stated on Twitter it was an indication of “the community idling forward of initiatives coming on-line.”

Aptos backers embody most of the enterprise capital companies which have develop into mainstays within the business: Andreesen Horowitz, Multicoin Capital, Bounce Crypto, Tiger World Administration, Blocktower Capital, and Coinbase Ventures. And within the run-up to its launch, the challenge closed a $200 million strategic spherical and a $150 million Collection A spherical.

That record additionally contains two corporations which have since filed for chapter: Hedge fund Three Arrows Capital and FTX Ventures, the enterprise arm of Sam Bankman-Fried’s crypto empire.

Keep on high of crypto information, get each day updates in your inbox.

from Cryptocurrency – My Blog https://ift.tt/fFTgJ5h

via IFTTT

No comments:

Post a Comment