The worth of the most important sensible contracts platform, Ethereum continues to achieve power in opposition to the US greenback, particularly with its latest transfer above $1,600. Restoration is predicted to proceed after the Federal Open Market Committee (FOMC) assembly and choice on the rate of interest hike in two days.

Consultants say that cryptos might usually retreat earlier than then, thus shaking out weak hangs earlier than carrying on with the bullish transfer aiming for highs above $2,000. Ethereum worth had pulled again to commerce at $1,594 on the time of writing with assist round $1,500 anticipated to soak up the rising promoting stress.

Ethereum Value Primed for A Huge Breakout – Right here’re the Ranges to Watch

Buyers are anxiously ready for the Federal Reserve choice on rate of interest hikes and count on the regulator to proceed with its strict measures to curb financial progress. Nevertheless, market watchers are eyeing a 25-basis factors improve, comparatively decrease than the December hike of 50-basis factors.

This constructive sentiment hails from a normal inflation drop for December to six.5% from 7.1% recorded for November. Though the drop just isn’t large enough to see the Fed raise the foot off the fuel pedal fully, it alerts that the economic system is headed in the suitable course.

CPI is an indicator for the Fed to both tighten its financial measures used to fight inflation or loosen its grip – permitting markets to get better, particularly these thought of to have a excessive volatility index like digital belongings.

In the meantime, Ethereum worth remains to be able to interrupt out considerably regardless of the resistance at $1,680. Because the tentative assist at $1,600 has already been infiltrated, ETH worth could be pressured to look all the way down to $1,500 earlier than the resumption of its uptrend. Based mostly on the day by day timeframe chart, the 200-day Exponential Transferring Common (EMA) (in purple) solidifies assist in that space.

Including credence to the short-term bearish outlook in Ethereum worth is a purchase sign from the Transferring Common Convergence Divergence (MACD) indicator. The MACD line in blue confirmed the decision to merchants to dump their luggage whereas locking in income (shaking off weak fingers) by flipping beneath the sign line in blue.

Physician Revenue, analyst and dealer on Twitter shared together with his massive following on Twitter that “weak fingers are getting shaken out, market awaits FOMC in two days.” The analyst phrases the pullback a “faux dumb” meant to “shake out weak fingers” forward of the subsequent breakout in a couple of days.

The identical day by day chart reveals the formation of a falling wedge, whose breakout helped Ethereum worth maintain the uptrend to $1,680 in January. It’s price mentioning that ETH worth at present exchanges fingers roughly midway by means of the 46.55% breakout goal.

For such a large upswing to $1,947, a retracement could be anticipated earlier than one other sharp transfer. That mentioned, assist on the 200-day EMA stays essential to the resumption of the uptrend. Nevertheless, bulls may hasten the restoration course of by reclaiming the misplaced floor above $1,600.

With this assist stage in place, investor confidence within the uptrend may develop, thus flipping the chances in favor of a fast transfer to shut the hole to $1,947 and later open the door to good points above $2,000.

Famend dealer and crypto analyst, Rekt Capital knowledgeable his 334k followers on Twitter Ethereum remains to be able to breakout above the month-to-month downtrend resistance. In response to his chart, such a transfer would convey Ethereum worth to $2,275. On different hand, failure to efficiently obtain this transfer may see Ethereum retest assist at $1,068.

Key Fundamentals to Look ahead to Ethereum Value

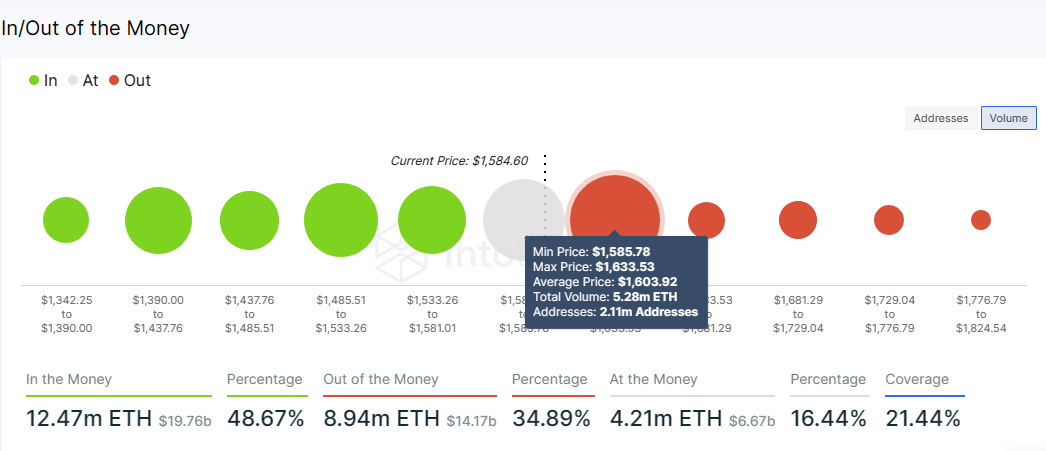

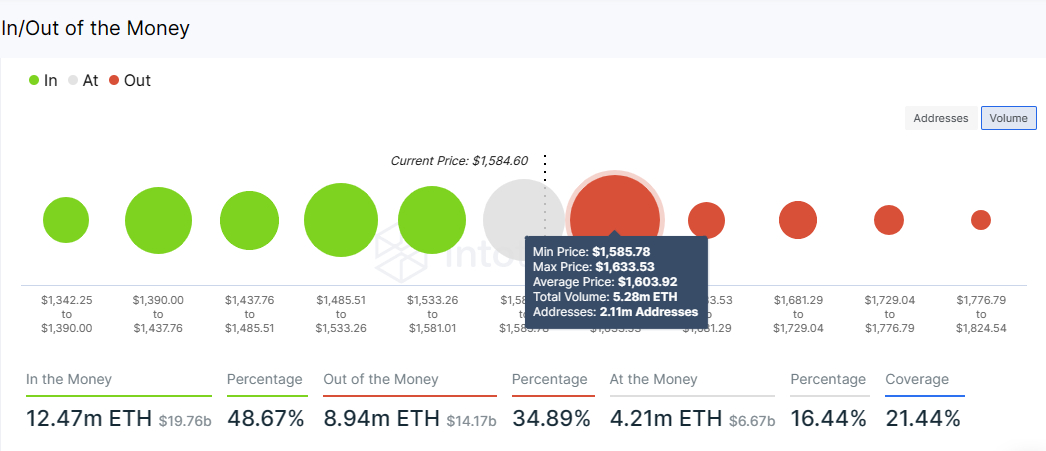

The area between 1,585 and $1,633 is house to at the very least 2.11 million addresses that bought 5.28 million ETH up to now. These addresses are at present out of the cash (dealing with an unrealized loss) in response to on-chain information introduced by IntoTheBlock (ITB).

The immense presence of sellers on this zone signifies that as Ethereum worth recovers, some buyers might promote at their varied breakeven factors, leading to a spike in overhead stress. Bulls want to organize for such eventualities as they push ETH worth to larger ranges.

A transparent break above this extensive vendor congestion might be the one enhance wanted to propel Ethereum to the wedge breakout goal at $1,947 and probably information ETH above $2,000.

On the flip facet, Ethereum assist sits above clusters of medium-to-strong assist areas – illustrated by the inexperienced circles. Subsequently, the continuing pullback might not stretch under $1,500. Furthermore, it validates the value evaluation above.

The bullish outlook in Ethereum worth will enormously rely upon the Fed’s choice on rates of interest. A break above $2,000 is required to verify a long-term bullish development in ETH however declines to $1,500 and the 100-day EMA (in blue) at $1,400 can’t be dominated out, at the very least not for now.

That mentioned, a breakout to $10,000 in 2023 might be a tall order for Ethereum worth. Nevertheless, the token might shut in on its all-time excessive of $4,878, particularly if bulls assist the second restoration section above $2,000 over the approaching days, probably a couple of weeks.

Ought to You Purchase Ethereum In the present day?

Earlier than you spend money on Ethereum, you could need to contemplate different high-potential crypto tasks alongside ETH.

We have reviewed the highest 15 cryptocurrencies for 2023, as analyzed by the CryptoNews Trade Speak workforce.

The record is up to date weekly with new altcoins and ICO tasks.

Disclaimer: The Trade Speak part options insights by crypto business gamers and isn’t part of the editorial content material of Cryptonews.com.

Associated Articles:

from Ethereum – My Blog https://ift.tt/hPfb7Ne

via IFTTT

No comments:

Post a Comment