Tether USDT’s market dominance has risen to its highest degree since November 2021, in response to DeFillama knowledge. However, Binance-backed BUSD has seen its provide shrink by roughly $2 billion within the final 30 days.

In keeping with DeFillama knowledge, the highest three stablecoins management roughly 92% of the market. USDT is the dominant stablecoin within the crypto house, with its dominance at 49.18%, whereas stablecoins like Circle’s USD Coin have a market dominance of 31.05%. BUSD’s dominance stood at 11.52% as of press time.

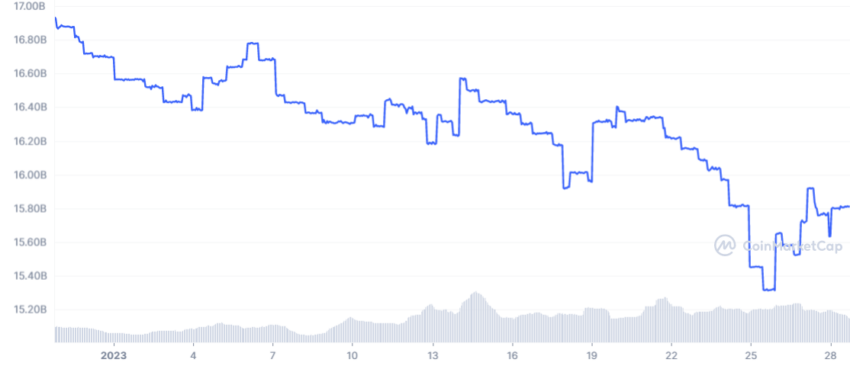

Stablecoin’s Market Cap Declined to $137 Billion

A not too long ago launched stablecoins report by CryptoCompare acknowledged that the full market cap of stablecoins has declined for ten straight months to $137 billion this January. The report added that the bottom market cap stablecoins have been since 2021.

In keeping with the report, USDT’s market cap barely rose 0.82% to $66.7 billion, whereas its vital rivals, USDC and BUSD, fell 2.27% and three.97% to $43.1 billion and $16.1 billion, respectively. In the meantime, the market cap of lesser-known stablecoins like True USD (TUSD) and failed algorithmic stablecoin TerraClassicUSD (USTC) rose 24.5% and 13.1% to $940 million and $225 million, respectively.

BUSD Had a Troubled January

The Binance-backed stablecoin has skilled a turbulent previous month after studies emerged about previous mismanagement.

Bloomberg reported on Jan. 10 that the mismanagement at occasions left BUSD’s reserves with over $1 billion in lacking collateral. Apart from that, the Changpeng Zhao-led alternate admitted that it retains collateral for its BNB Good Chain and BNB Beacon Chain tokens in the identical pockets as buyer funds.

These revelations elevated the FUD surrounding the alternate as customers withdrew their property en masse. BeinCrypto reported that Binance’s outflows topped 25% inside two months. In keeping with the report, the flows had been led by its Paxos-issued stablecoin BUSD and native BNB coin.

In the meantime, amidst all of the uncertainty, Binance’s CZ insisted that the alternate had a wholesome steadiness e-book. The CEO not too long ago tweeted that conventional finance agency reducing their publicity to crypto because of the failure of current crypto tasks would possibly face “existential implications” in twenty years.

Disclaimer

BeInCrypto has reached out to firm or particular person concerned within the story to get an official assertion concerning the current developments, however it has but to listen to again.

from USDT Crypto – My Blog https://ift.tt/myDRMFh

via IFTTT

No comments:

Post a Comment