- Ethereum turned inflationary as community provide charges fail to surge

- Community validators stay staunch of their obligation to keep away from slashing occasions whereas ETH consolidated

Ethereum’s [ETH] quest for profitability took one other bitter flip because it returned to inflationary situation after just a few makes an attempt on the reverse. In response to Token Terminal, the decentralized blockchain every day incomes within the final 12 months revealed a really low worth.

Therefore, indicating that community positive factors had been nearly non-existent. By inflationary, it meant that Ethereum on-chain transactions on the community had been extraordinarily low. So, it has additionally turn into troublesome for Ethereum to document will increase in gasoline charges.

Ethereum is unprofitable / inflationary once more 📉 pic.twitter.com/6glPmYYCWu

— Token Terminal (@tokenterminal) December 4, 2022

Learn Ethereum’s [ETH] Value Prediction 2023-2024

Amid the aforementioned happenings, Token Terminal additionally revealed that it had affected Ethereum’s income which dropped by 4.7% within the final 24 hours. Similar as the provision aspect charges which witnessed a 5.3% decline throughout the identical interval.

Belief not the method?

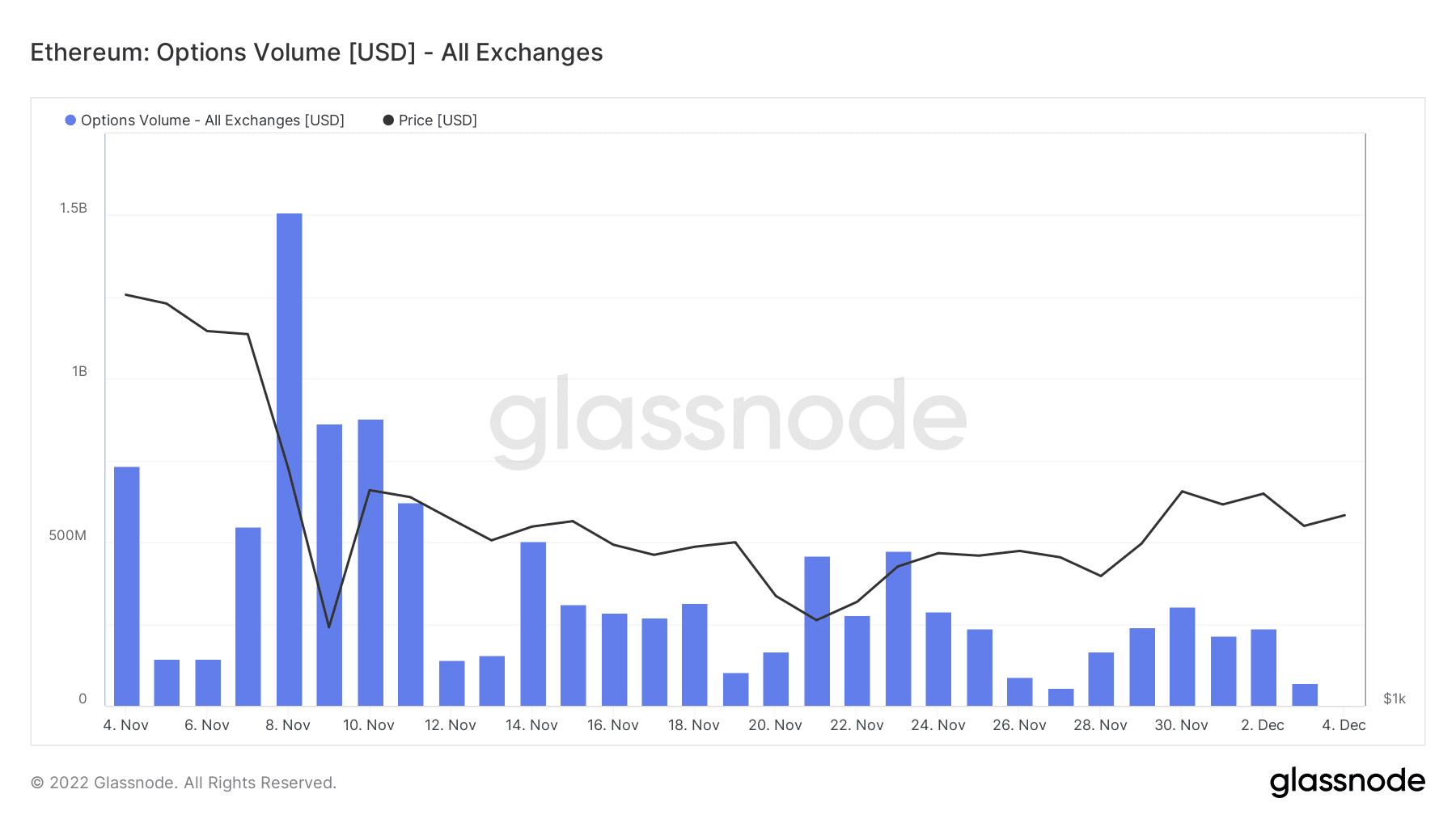

The availability part was not the one stricken one throughout the Ethereum blockchain. In response to Glassnode, curiosity in funding the choices market had additionally been met with roadblocks. At press time, knowledge from the on-chain platform confirmed that the choices quantity throughout all exchanges was $71.52 million.

This worth was an apparent lower from the provision for many of November. Following the plunge, it implied that contracts open for Ethereum weren’t spectacular. This additionally implied that merchants didn’t belief the altcoin sufficient to execute trades of their favor.

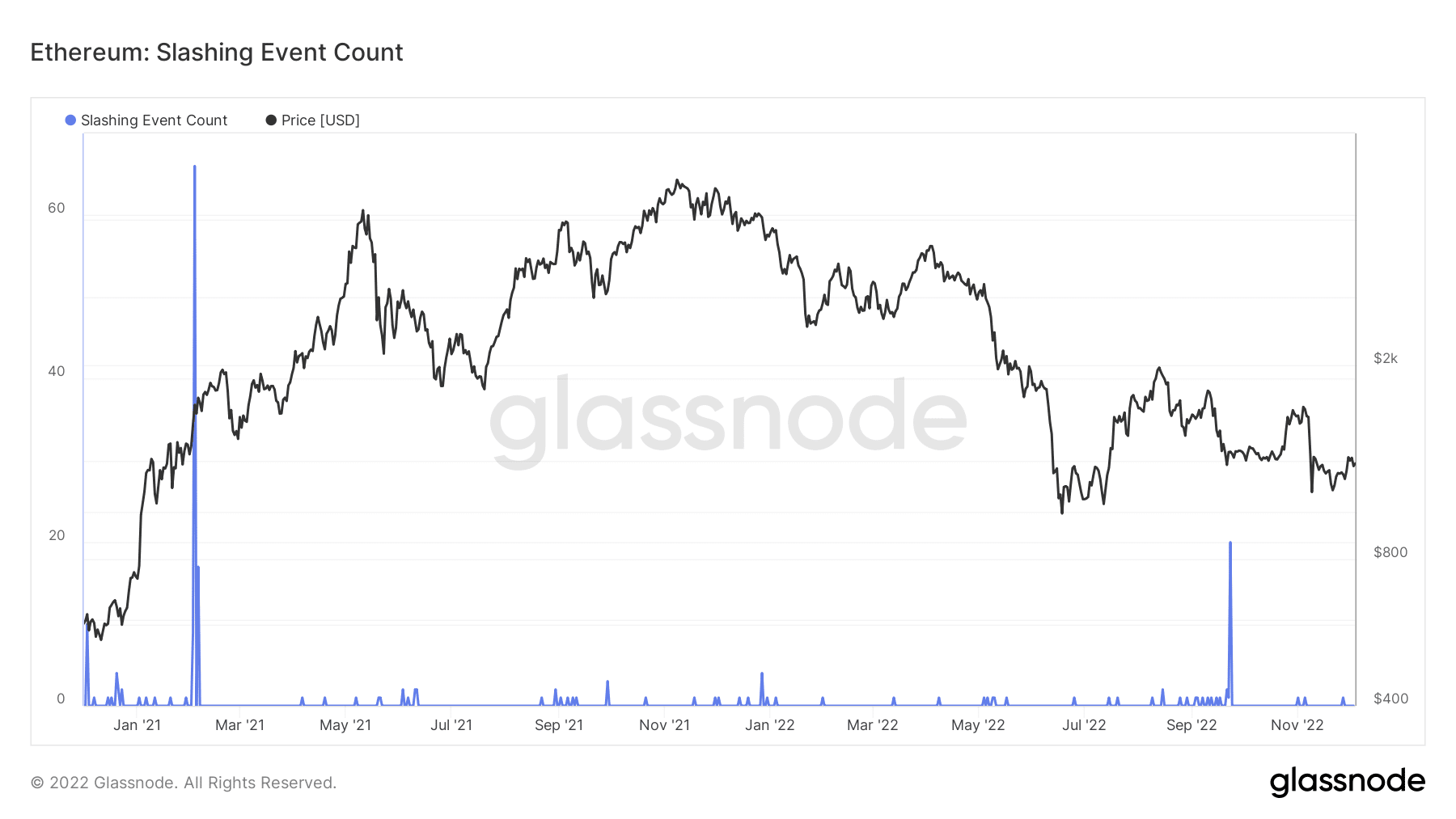

Furthermore, not all elements of the community had been down within the drain. For some just like the slashing occasion rely, this was a interval to render a serving to hand to the community. As of this writing, the Ethereum slashing occasion rely was zero regardless of disorderliness just a few days after the Merge.

At level zero, it implied that there had been fewer instances of proposing invalid blocks. Neither has there been a case of verifying an invalid fork to the Ethereum blockchain. So, there have been little considerations concerning the community’s well being as validator conduct has not been messy.

ETH, what about you?

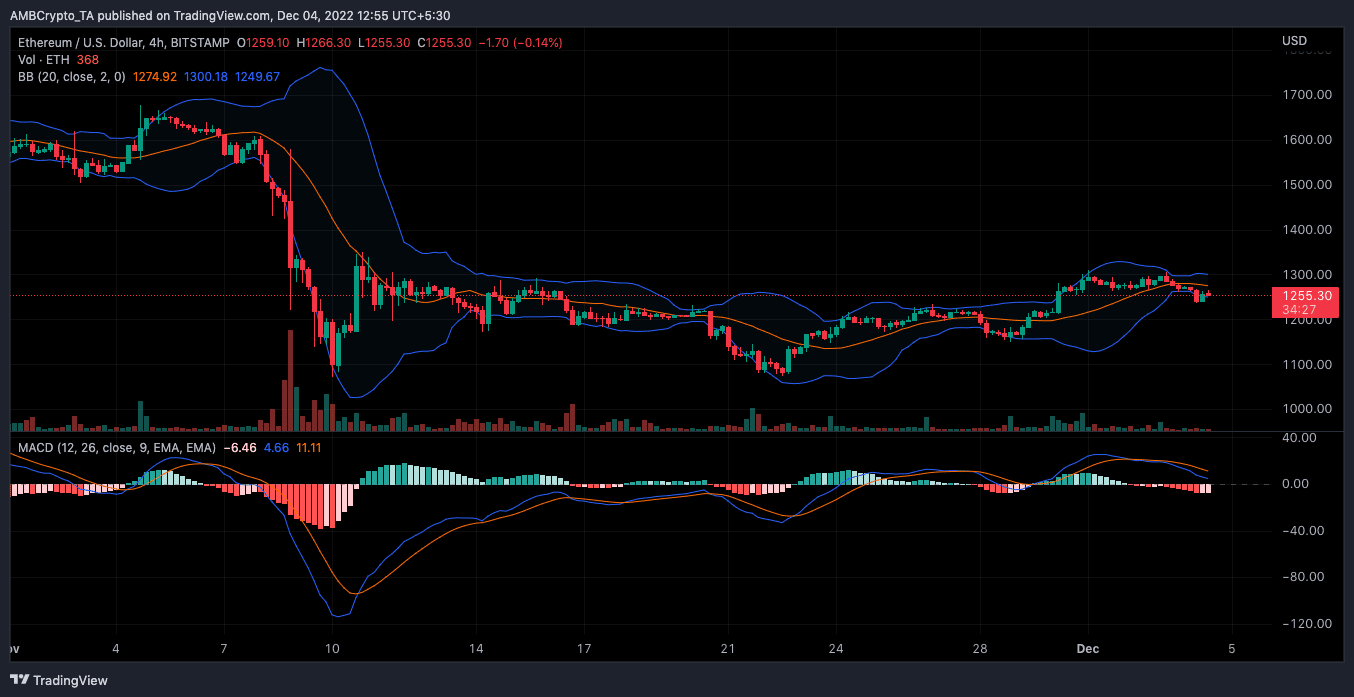

As for the ETH value, it has been capable of maintain above the $1,000 area. Based mostly on CoinMarketCap knowledge, ETH was buying and selling at $1,255 on the time of writing. This worth illustrated a 2.10% decline within the final 24 hours, as was the case for a lot of cryptocurrencies.

In addition to, ETH was much less prone to exit the present zone within the brief time period. This was as a result of the four-hour chart confirmed that the altcoin was removed from excessive volatility as indicated by the Bollinger Bands (BB).

By way of its Transferring Common Convergence Divergence (MACD), ETH’s momentum was largely bearish. At a MACD worth of -6.46, it would require an all-inclusive concord for consumers to reverse the state of affairs.

No comments:

Post a Comment