ugurhan/iStock through Getty Pictures

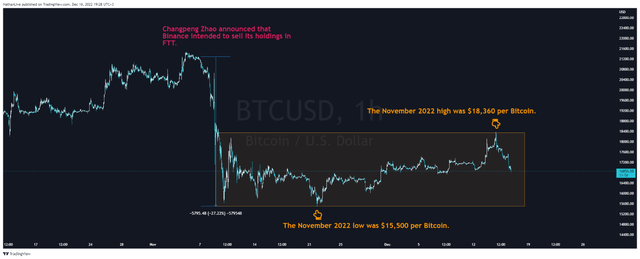

A month after the collapse of the FTX (FTT-USD) cryptocurrency alternate and a month-long interval of consolidation within the vary of $15,500-$17,200 per Bitcoin (BTC-USD), the preferred cryptocurrency was attempting to interrupt out of the bearish development and was buying and selling above $18,000 for a short while. Regardless of the looks of the primary indicators of optimism out there, the state of affairs started to worsen once more, primarily resulting from information of a possible felony case towards the world’s largest crypto alternate Binance (BNB-USD), and doubts concerning the high quality of the audit report on its reserves. In consequence, on December 13, Binance prospects withdrew funds within the quantity of about $1.9 billion, which is without doubt one of the largest values in recent times.

N_Aisenstadt – TradingView

In the mean time, the important thing duties for analysts, buyers, and merchants of cryptocurrencies are to find out whether or not the short-term interval of sideways motion is only a respite earlier than the continuation of the bearish development or whether or not the state of affairs out there has begun to alter and we will see a restart of the bull cycle once more. On this article, I’ll current an evaluation of the affect of the Fed’s rate of interest hike on the crypto trade, the monetary state of affairs of miners, and the state of affairs round Binance and Tether, which is the world’s largest stablecoin.

The state of affairs across the largest crypto alternate Binance

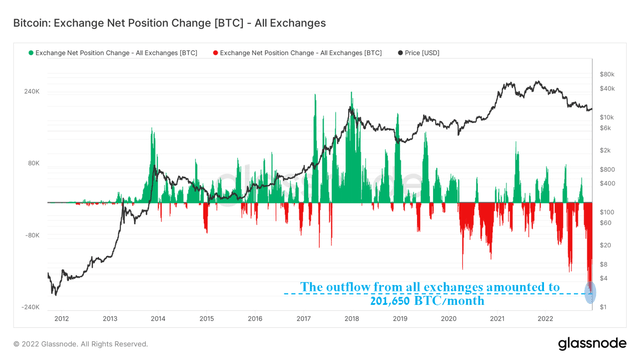

Greater than a month has handed because the chapter of one of many world’s largest cryptocurrency exchanges, FTX, however on the identical time, the nervousness in society doesn’t fade away however solely intensifies. That is mirrored within the withdrawal of Bitcoins from exchanges to chilly wallets or their alternate for fiat currencies. Within the first half of December, the speed of withdrawal of cash reached a report stage of 201,650 Bitcoins per 30 days, which has not occurred because the emergence of cryptocurrencies as funding property.

Writer’s elaboration, primarily based on Glassnode

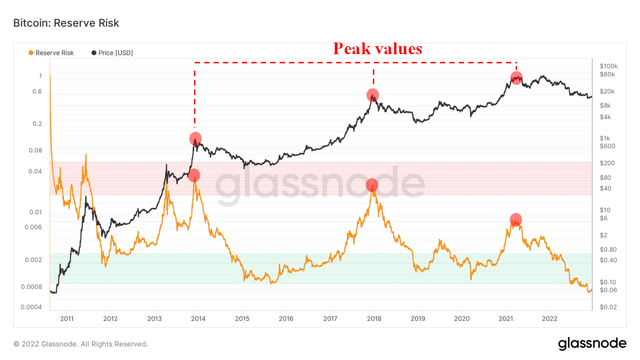

Furthermore, one of many key cyclical indicators, specifically Reserve Threat, can be utilized to find out the ratio of threat and reward in relation to the arrogance of long-term buyers in Bitcoin. This indicator is ready to mannequin the connection between the present value of an asset and buyers’ confidence in its capability to rise in value sooner or later. In the mean time, Reserve Threat continues to fall, which signifies that the panic out there continues, which is what long-term buyers benefit from by accumulating Bitcoin. These buyers are satisfied of the prospects for the worldwide use of cryptocurrencies and go towards the opinion of most merchants and buyers on the lookout for extra conservative property. Traditionally, when this indicator fell to 0.008 and under, then this era marked the presence of Bitcoin in a late bearish cycle and shortly, there’s a excessive likelihood of the start of its accumulation part, which often lasts from 1 to three months, adopted by a development change from bearish to bullish.

Writer’s elaboration, primarily based on Glassnode

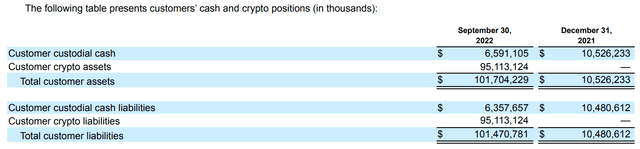

Over the previous 5 weeks, the top of Binance has been attempting to enhance the funding attractiveness of the crypto market and scale back the diploma of pressure amongst market contributors with a purpose to stabilize the costs of Bitcoin, Ethereum (ETH-USD), and different property. Nonetheless, as usually occurs, his actions solely prompted bewilderment and elevated criticism in his route. After the FTX crash, Changpeng Zhao is eager to reveal that Binance, not like many different crypto exchanges, has the required reserves to cowl purchasers’ property and liabilities. At first, the top of Binance questioned the reserves of Coinbase (COIN), however this solely barely broken his repute, since Coinbase is a public firm that publishes monetary statements each quarter, present process a radical audit.

Writer’s elaboration, primarily based on quarterly securities report

Nonetheless, the monetary report was too transient, it lacked details about Binance’s obligations to 3rd events and, most significantly, it lacked details about the issuance of Binance Coin and its use in conducting numerous funding actions of the corporate. In consequence, the printed superficial report solely angered the crypto group and led to a multibillion-dollar outflow of property from Binance and confused international economists answerable for auditing and monetary reporting.

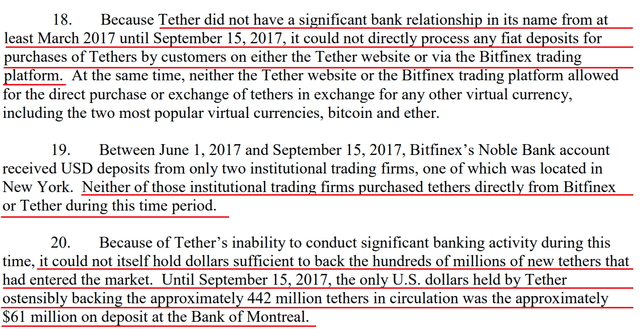

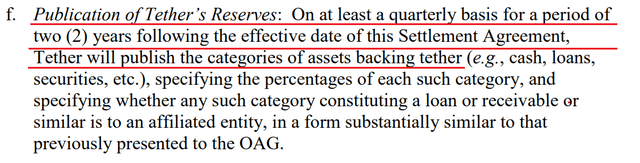

I consider that crypto alternate reserve reporting remains to be a painful matter for an trade that dates again lengthy earlier than the FTX crash and in consequence, harder motion from regulators is required. For instance, in courtroom circumstances between the New York Lawyer Normal’s workplace and Tether, whose predominant objective is to exchange the greenback to facilitate the buying and selling of digital currencies, it was demonstrated that although Tether (USDT-USD) is required to be absolutely backed by the greenback held in reserve, however that was removed from the case in 2017.

Writer’s elaboration, primarily based on a settlement settlement between Tether and NYAG

Because of the settlement reached between the 2 events, along with a multi-million greenback superb, Tether should publish a report each quarter to verify the principle stablecoin is dependable.

Writer’s elaboration, primarily based on a settlement settlement between Tether and NYAG

As usually occurs, Tether’s first audit report got here out clumsy and was a doc containing solely two charts wherein there was no full details about Tether’s reserves. Over time, the standard of reviews has improved, however they’re nonetheless removed from the extent of public corporations traded on exchanges such because the Nasdaq (NDAQ), the New York Inventory Alternate, and the Tokyo Inventory Alternate.

I consider that the leaders of the crypto trade must take the initiative and begin hiring probably the most revered audit companies, giving them full entry to their actions. The primary causes for this are demonstrating to Wall Road that the crypto trade has come a great distance in its growth and demonstrating to regulators within the US and Europe that they’re prepared to work collectively to extend folks’s stage of belief in cryptocurrencies.

The affect of the Fed fee hike on Bitcoin

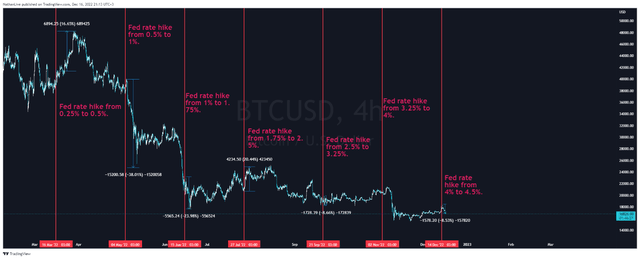

The Fed is efficiently dealing with slowing inflation by continued rate of interest hikes, however like several determination, there are optimistic and unfavourable penalties. The draw back of the Fed’s fee hike is the continued decline within the value of cryptocurrencies and continued downward stress on the inventory market as merchants and buyers search to hedge towards a possible recession.

In 2022, the historic chart of Bitcoin exhibits that its value has declined by greater than 8% usually because the FOMC conferences, wherein the choice to boost the rate of interest was made. Particularly vital drops within the value of Bitcoin occurred in Could and June when it fell by greater than 20%. The logical clarification for this development is the elevated funding attractiveness of such property as Treasury bonds (US10Y) (US2Y), whose yields have elevated considerably in current quarters.

N_Aisenstadt – TradingView

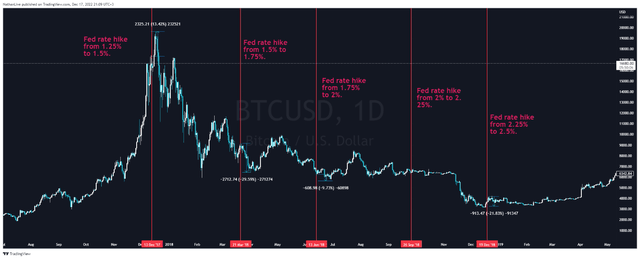

An identical development occurred in 2017-2018, which solely reinforces my assumption that the rise within the Fed’s rate of interest is negatively mirrored in high-risk property.

N_Aisenstadt – TradingView

On December 14, 2022, Jerome Powell acknowledged the next throughout a press convention.

“However there’s an expectation, actually, that the — that the providers inflation is not going to transfer down so shortly, in order that we’ll have to remain at it in order that we could have to boost charges greater to get to the place we wish to go. And that is actually why we’re writing down these excessive charges and why we’re anticipating that they’re going to have to stay excessive for a time.”

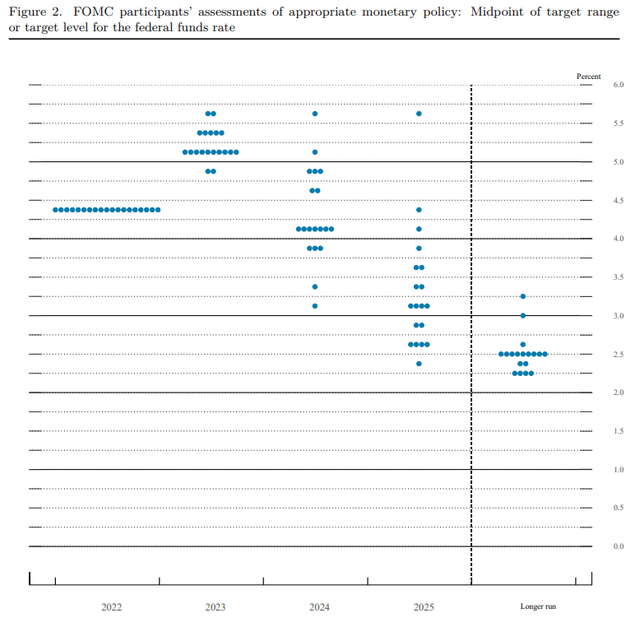

FOMC contributors anticipate a continuation of tight financial coverage in 2023 and that the Fed’s rate of interest could exceed 5%, which is a report worth in current a long time.

Federal Reserve System

In consequence, I consider that there might be a rise in volatility amongst cryptocurrencies within the coming weeks and one of the crucial appropriate selections is to cut back the variety of transactions till the formation of a clearer development, which at all times comes after the tip of a crypto blizzard.

Monetary place of crypto miners within the second half of 2022

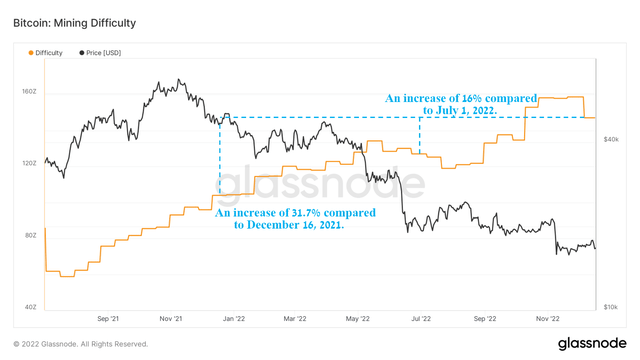

Within the second half of 2022, the issue of Bitcoin mining is rising relentlessly and thereby lowering the margins of crypto miners experiencing among the most troublesome intervals of their historical past, which might outcome of their huge chapter if the value of BTC continues to stay under the price of its manufacturing for at the least three extra months. So, as of December 16, mining issue elevated by 31.7% in comparison with the earlier yr and by 16% in comparison with the start of the third quarter of 2022.

Writer’s elaboration, primarily based on Glassnode

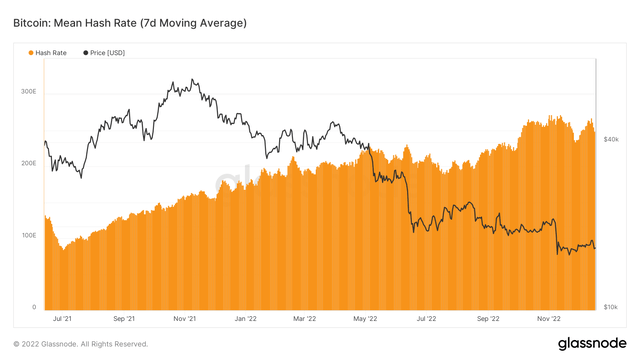

Furthermore, the competitors amongst miners can also be evident within the improve within the Bitcoin hash fee, which reached a report excessive of 267.4 Exahash per second, which is a 23.5% improve since July 1, 2022.

Writer’s elaboration, primarily based on Glassnode

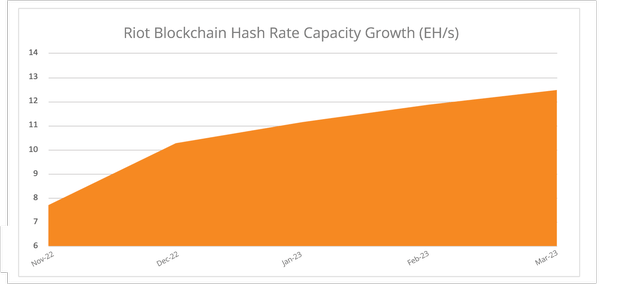

One of many leaders within the trade, specifically Riot Blockchain (RIOT), in its press launch acknowledged that the full hashing energy might attain 12.5 EH/s throughout the first quarter of 2023, which is considerably greater than the earlier yr.

Riot Blockchain press launch

On the one hand, this means the continued confidence of the corporate’s administration and buyers within the development in asset costs, however then again, it will negatively have an effect on smaller miners, who discover it harder to acquire the funding essential to proceed their operations.

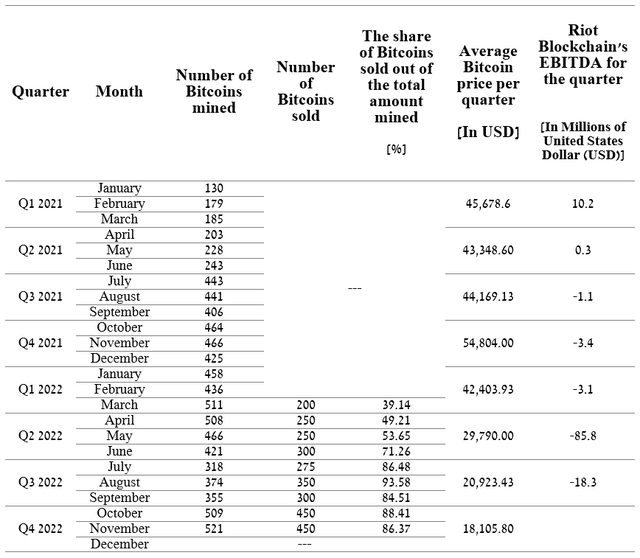

If we contemplate historic traits, then the rise in community issue requires the biggest miners to always improve the quantity of apparatus and thereby not solely will increase the one-time value of their buy but additionally results in a rise in the price of their upkeep and electrical energy. In consequence, this negatively impacts the flexibility of trade leaders to realize optimistic EBITDA, even at occasions when the value of Bitcoin reaches multi-year highs. For instance, within the 4th quarter of 2021, Riot’s EBITDA was -3.1 million US {dollars}, with a mean value of Bitcoin of $54,804.

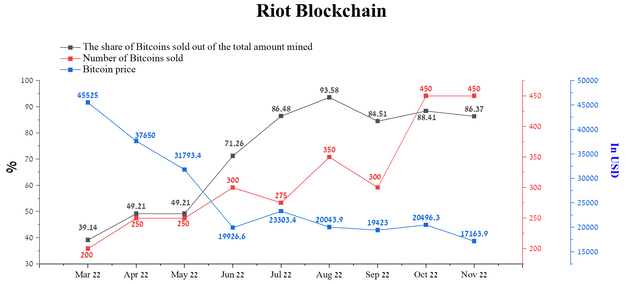

Created by writer

Furthermore, the unfavourable level within the conduct of Riot’s administration is the truth that the share of cash that had been offered from the full variety of Bitcoins mined is rising from month to month, regardless of the autumn of their worth. In different phrases, I consider that the effectiveness of the enterprise mannequin constructed underneath the management of Jason Les shouldn’t be excessive, because the firm has not offered Bitcoins within the volumes which were in current months. So, for instance, Riot offered solely 200 cash in March 2022, whereas this worth elevated by 125% in November 2022, however the value of Bitcoin fell 62.9%.

Created by writer

Conclusion

The required reforms within the crypto trade could also be painful for sure market contributors, however in the long term, extra buyers and merchants will be capable to belief crypto exchanges extra. As well as, I consider within the pressing must introduce audit management over cryptocurrency builders, as it will present how a lot and the way investor cash is spent on mission growth and enhance the funding local weather within the crypto group. In consequence, extra conservative buyers from the inventory markets will be capable to start to view cash not as simply nugatory property, however as one thing that has the potential to enhance sure points of individuals’s lives.

The crypto miner enterprise continues to undergo from a months-long “crypto winter” as the price of mining Bitcoin exceeds its present value. However even during times of mass euphoria, when the expansion within the value of the preferred coin considerably exceeded the expansion fee of the S&P 500 (SPY), the EBITDA of one of many trade leaders, specifically Riot Blockchain, remained within the unfavourable zone. The important thing causes for this may be not solely the inefficiency of the enterprise mannequin but additionally the shortcoming of corporations from the crypto trade to extend the hash fee quicker than the expansion fee of community issue.

Usually, I consider that as quickly as information begins to seem signaling a discount within the Fed rate of interest, it will grow to be one of many predominant triggers that may result in a major improve in funding curiosity not solely in cryptocurrencies but additionally in shares of corporations traded with a beta larger than 1 and elevated monetary ratios. In response to my mannequin, the Fed’s rhetoric is not going to start to melt within the subsequent two quarters, and in consequence, I preserve the expectation that the Bitcoin value backside might be within the $12,700-$13,600 vary and can happen in early 2023. Nonetheless, earlier than that, we’re ready for a rise in volatility within the crypto market, and novice buyers must be most cautious in making selections.

from Cryptocurrency – My Blog https://ift.tt/7kcrpM1

via IFTTT

No comments:

Post a Comment