Disclaimer: The Business Speak part options insights from crypto trade gamers and isn’t part of the editorial content material of Cryptonews.com.

Crypto index funds are tasked with monitoring a basket of digital currencies. This permits traders to realize publicity to a diversified portfolio of cryptocurrencies by means of a single funding.

On this information, we discover the 7 finest crypto index funds out there.

7 Greatest Cryptocurrency Index Funds to Purchase 2022

The 7 finest crypto index funds are listed beneath:

- Dash 2 Trade Crypto Presale – Higher Different to Crypto Index Funds

- Bitwise 10 Crypto Index Fund – Weight Index Fund of the Prime 10 Cryptos by Market Cap

- eToro Sensible Portfolios – Select From 14 Professionally-Managed Crypto Sensible Portfolios

- Galaxy Crypto Index Fund – Put money into 12 Totally different Cryptocurrencies With Month-to-month Rebalancing

- Nasdaq Crypto Index Fund – Diversified Basket of Market Cap Weighted Cryptocurrencies

- Constancy Crypto Business and Digital Funds Index – Diversified Portfolio of Crypto-Centric Shares

- Bitwise DeFi Crypto Index Fund – Put money into the Way forward for Decentralized Finance

Every crypto index fund will differ by way of the digital currencies it elects to trace, along with the weighting and rebalancing technique utilized.

Subsequently, traders can learn on to select one of the best crypto index fund for his or her monetary objectives and tolerance for danger.

Reviewing the Greatest Crypto Index Funds 2022

As famous above, no two crypto index funds are the identical. Every crypto index fund will comprise a particular basket of digital currencies at numerous weights.

Furthermore, the chosen cryptocurrencies will usually be decided by market capitalization. Because of this the crypto index fund will recurrently rebalance its monitoring benchmark.

As soon as once more, this may differ from one crypto index fund to the subsequent.

1. Crypto Presales – A Higher Different to Crypto Index Funds

We should always begin by noting that general, there are significantly better alternate options to crypto index funds. From an funding perspective, the overwhelming majority of crypto index funds concentrate on large-cap digital currencies. Contemplating that the broader market has been bearish for almost 12 months, this gives little in the best way of upside potential.

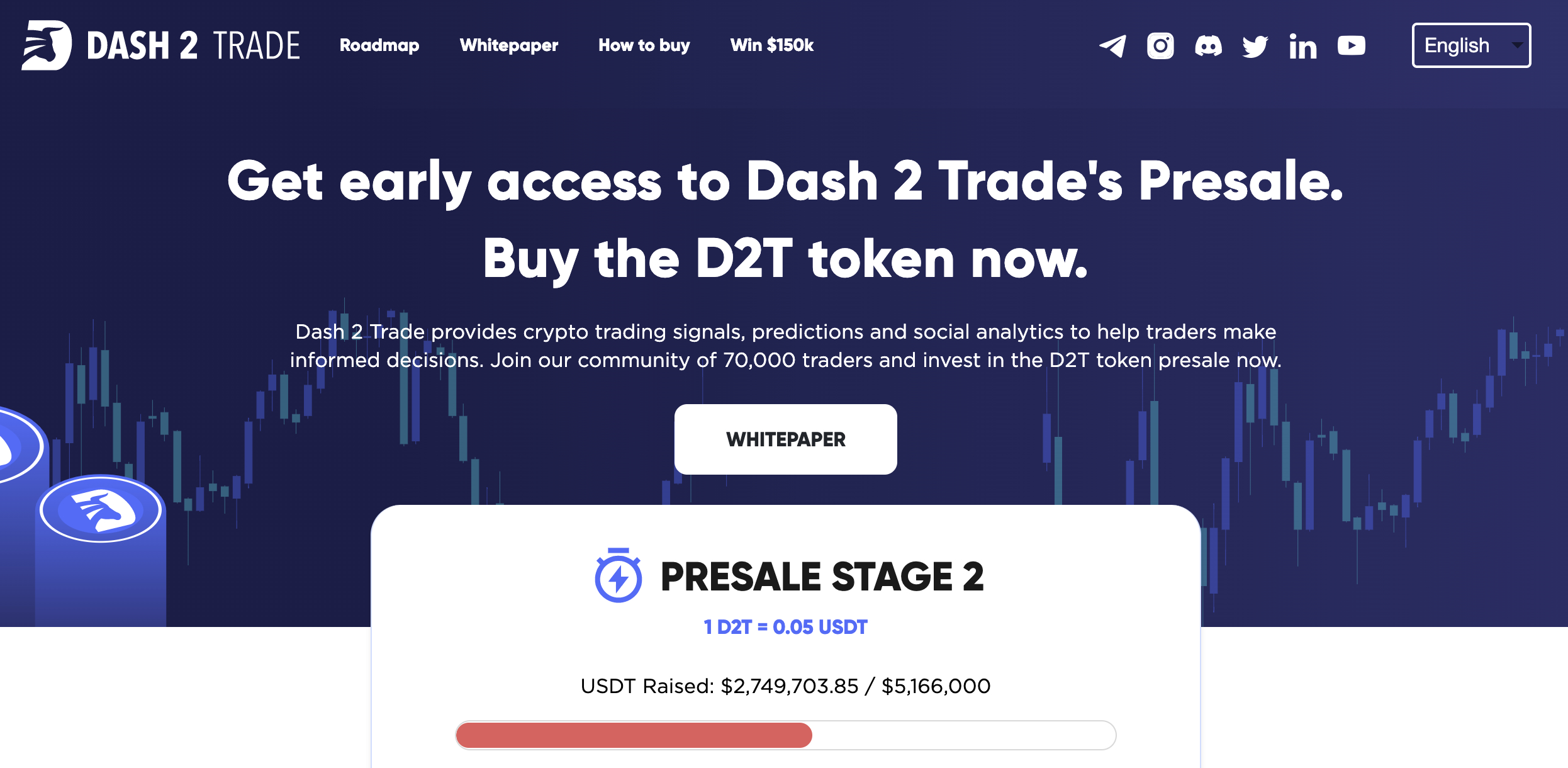

As an alternative, traders may take into account crypto presales – which provide early entry to newly launched digital currencies. Not solely that, however early traders get a reduced worth when in comparison with that of the next change itemizing. On this regard, traders might want to discover to Sprint 2 Commerce presale – which in simply two weeks has already raised greater than $4 million.

What’s Sprint 2 Commerce?

Dash 2 Trade – backed by the D2T token, is within the early-to-mid phases of constructing and launching its cutting-edge analytics terminal. This can provide traders from all around the world a one-stop-shop for crypto knowledge, the best crypto tools, options, and funding insights. For instance, Sprint 2 Commerce customers may have entry to social and on-chain metrics.

The latter flags a sign when a whale token motion is tracked. Social metrics, alternatively, scan Reddit and different fashionable platforms across the clock within the hunt for trending cash. Sprint 2 Commerce additionally supplies alerts on new change itemizing bulletins, which regularly end in a right away bullish development for the respective undertaking.

Maybe better of all, Sprint 2 Commerce customers also can entry buying and selling indicators that recommend trades made on the aforementioned metrics. That is along with the undertaking’s staff of in-house merchants which can be tasked with analyzing the crypto markets by way of technical and basic evaluation. Sprint 2 Commerce indicators inform customers of which orders to position – resembling a purchase/promote, restrict, stop-loss, and take-profit.

Sprint 2 Commerce may also curiosity those who want to commerce in an automatic method. Its strategy-building ecosystem – which operates on a what-if foundation, promotes automated buying and selling in a risk-averse manner. It’s because the automated technique might be examined by way of a backtesting facility that mirrors dwell crypto market situations.

Now on to the Sprint 2 Commerce presale. In a nutshell, the presale is seeking to elevate $40 million throughout 9 incremental phases. Every stage will increase the worth for presale traders, so getting in early is at all times useful. As of writing, the presale is in part two. This costs D2T tokens at $0.05.

The presale helps ETH and USDT, along with bank card funds by way of a 3rd social gathering. Finally, not solely is Sprint 2 Commerce a terrific various to digital asset index funds, but it surely could possibly be the next cryptocurrency to explode.

What’s IMPT?

Along with Sprint 2 Commerce, IMPT is one other newly launched crypto undertaking that’s at the moment providing its native digital asset by way of a presale marketing campaign. IMPT is seeking to revolutionize the carbon credit score trade by providing an inclusive buying and selling and offsetting platform that’s constructed on blockchain expertise.

After shopping for IMPT tokens, the digital belongings are transformed to carbon credit by way of NFTs. This can enchantment to firms that have to receive extra carbon emissions for the respective 12 months. Carbon credit commerce on the worldwide scene, which suggests that there’s a rising market for this rising asset.

As such, traders should purchase IMPT tokens within the hope that carbon credit score costs rise. If that is so, the investor can promote their tokens to different IMPT customers on the secondary market. IMPT has already raised over $12 million in presale funding. IMPT tokens can nonetheless be bought at presale costs of simply $0.023.

What’s Calvaria?

The ultimate presale undertaking to think about as a substitute for crypto index funds is Calvaria. This play-to-earn gaming enviornment will allow gamers to earn crypto rewards for partaking with the Calvaria ecosystem. The primary idea of the sport relies on a battle card technique. Nevertheless, not like typical battle card video games, Calvaria makes use of blockchain and NFTs.

Because of this every battle card is owned by the participant. Furthermore, gamers can commerce their battle card NFTs on the Calvaria market. Calvaria is already in stage three of its presale marketing campaign. Its native digital asset, RAI, might be bought at an change fee of 1 USDT = 50 RAI. In stage 4 of the presale, 1 USDT will receive simply 40 RAI.

2. Bitwise 10 Crypto Index Fund – Weight Index Fund of the Prime 10 Cryptos by Market Cap

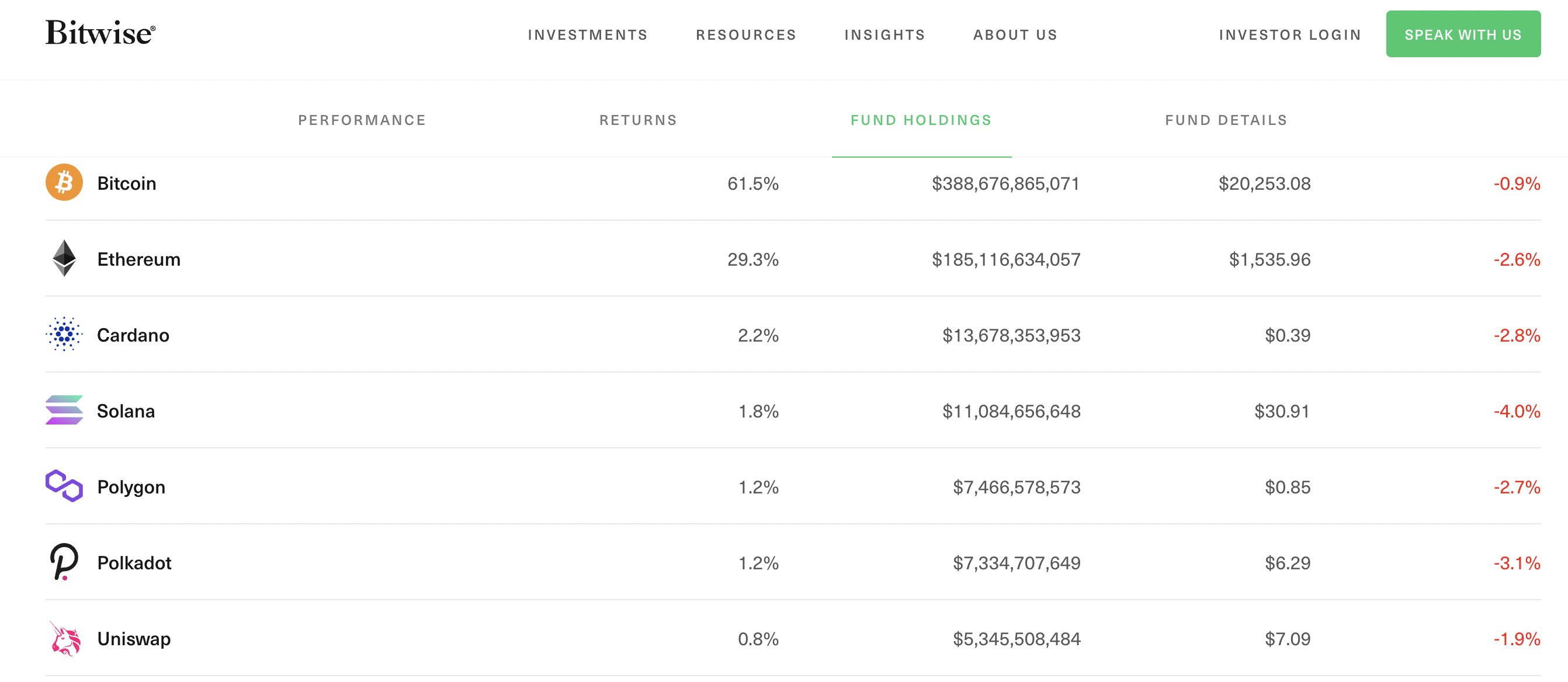

By way of particular crypto index funds, Bitwise is among the most notable benchmarks on this area. Because the title suggests, the Bitwise 10 Crypto Index Fund tracks the ten largest cryptocurrencies by market capitalization. Because of this the extra priceless a cryptocurrency is by way of its market capitalization, the extra it contributes to the index.

As of writing, Bitcoin and Ethereum contribute 61.5% and 29.3% to the index fund. In consequence, these two cryptocurrencies alone contribute over 91% of the general allocation. That is as soon as once more why crypto index funds are considerably unattractive, not least as a result of the overwhelming majority of the funding will usually be allotted to only two digital currencies.

Nonetheless, whereas there isn’t any efficiency charge, the Bitwise 10 Crypto Index Fund fees an expense ratio of two.5%. That is very expensive and in actuality, it could be cheaper to purchase the respective cryptocurrencies immediately from an change. This index fund for cryptocurrency has almost $400 million in belongings beneath administration and it carries the ticker image BITW.

By way of efficiency, the Bitwise 10 Crypto Index Fund has generated returns of 93.35 since its inception in December 2020. On a 12-mont foundation, nonetheless, the fund is down 70%. Lastly, this crypto index fund is rebalanced on a month-to-month foundation. This ensures that the fund is aligned with the broader market.

3. eToro Sensible Portfolios – Select From 14 Professionally-Managed Crypto Sensible Portfolios

These out there for one of the best crypto index funds may want to discover eToro and its Sensible Portfolios. eToro is an SEC-regulated on-line dealer that primarily helps crypto and inventory buying and selling, along with foreign exchange and commodities. Nevertheless, eToro can be fashionable for its Sensible Portfolios – that are professionally-managed baskets of belongings.

On this regard, eToro gives 14 totally different Sensible Portfolios that specialize completely in cryptocurrencies. Better of all, every Sensible Portfolio has its personal methods and targets, particularly in relation to weighting. For instance, the Balanced-Crypto Sensible Portfolio consists of 23 totally different cryptocurrencies – every of which is weighted equally at 4.33%.

This consists of every part from Bitcoin, Sprint, and Litecoin to ZCash, Maker, and EOS. Maybe much more attention-grabbing is the DAO Sensible Portfolio. This tracks 11 of the best altcoins that function a DAO framework, together with Uniswap, AAVE, SushiSwap, and Curve. Another choice is to think about the MetaverseLife Sensible Portfolio.

Not solely does this feature observe the best metaverse coins like Decentraland, Enjin, and the Sandbox, but in addition related shares – resembling Roblox and Meta Platforms. All in all – there’s a crypto Sensible Portfolio to swimsuit most targets. Not solely that, however the Sensible Portfolio minimal funding at eToro is simply $500.

There aren’t any extra charges to put money into Sensible Portfolios. Quite the opposite, the investor pays the underlying purchase and promote fee as and when the SmartPortfolio is ready up and rebalanced. eToro customers have entry to fee-free USD deposits by way of e-wallets and debit/bank cards. Sensible Portfolios might be accessed on-line or by way of the eToro cellular app.

Compare eToro Smart Portfolios Now

Your capital is in danger. Crypto asset investments are extremely unstable and speculative.

4. Galaxy Crypto Index Fund – Put money into 12 Totally different Cryptocurrencies With Month-to-month Rebalancing

Subsequent up on our listing is the Galaxy Crypto Index Fund. The aim of this fund is to trace the Bloomberg Galaxy Crypto Index like-for-like. This crypto index fund accommodates 12 digital currencies and weighting is targeted on market capitalization. In consequence, the portfolio is closely weighted to Bitcoin and Ethereum.

With that stated, not like the beforehand mentioned Bitwise crypto index fund, Galaxy caps the weighting to a most of 35% per coin. Because of this each Bitcoin and Ethereum are collectively weighted at 70%.

The rest of the portfolio consists of Cardano, Solana, Avalanche, Polkadot, Polygon, Cosmos, Litecoin, Chainlink, Uniswap, and Algorand. The Galaxy Crypto Index Fund was incepted in August 2017 beneath the ticker image BGCI – which makes it some of the established choices on this market.

5. Nasdaq Crypto Index Fund – Diversified Basket of Market Cap Weighted Cryptocurrencies

Incepted in 2020, the Nasdaq Crypto Index Fund is a well-liked choice for these searching for diversification by means of a single, managed funding. Nasdaq focuses on main cryptocurrencies throughout 11 tasks. Every digital forex being tracked should commerce on at the least two vetted exchanges.

Rebalanced each three months, this crypto index fund is as soon as once more weighted by market capitalization. As of writing, Bitcoin and Ethereum are weighted at over 69% and 27% respectively, which represents almost 97% of the general portfolio.

In consequence, simply 3% is left over for the remaining 9 cryptocurrencies. That is inclusive of Litecoin, Chainlink, Polkadot, Bitcoin Money, Stellar Lumens, Uniswap, Axie Infinity, the Sandbox, and Filecoin.

6. Constancy Crypto Business and Digital Funds Index – Diversified Portfolio of Crypto-Centric Shares

This Constancy cryptocurrency index fund will enchantment to traders that really feel extra snug with shares versus immediately investing in digital currencies. In a nutshell, the fund specializes completely in shares that function within the blockchain expertise and cryptocurrency trade.

The biggest holdings on this portfolio, at 17.2% and 10.7% respectively, are Block and Coinbase. Different constituents embrace Riot Blockchain, Cleanspark, Bakkt Holdings, Hut 8 Mining, Bit Digital and Bitfarms.

Among the shares inside this crypto index fund have taken an unprecedented beating over the prior 12 months. For instance, Bakkt and Bit Digital are down almost 95% and 92% respectively. The Constancy Crypto Business and Digital Funds Index comes with a cheap expense ratio of simply 0.39%.

7. Bitwise DeFi Crypto Index Fund – Put money into the Way forward for Decentralized Finance

Bitwise as soon as once more makes this listing of one of the best crypto index funds. This time, we are going to focus on the Bitwise DeFi Crypto Index Fund – which gives publicity to the expansion of decentralized finance. The fund accommodates 10 notable DeFi tasks at numerous weights.

Nevertheless, the fund is closely weighted to Uniswap at simply over 55%. Uniswap and Maker contribute 11.9% and seven.9% respectively. The rest of this crypto index fund is represented by Curve, Lido DAO, Convex Finance, Compound, Loopring, Yearn.finance, and 0x.

As per the opposite Bitwise crypto index fund that we mentioned earlier, the expense ratio stands at an expense of two.50%. Moreover, the minimal funding requirement to entry this crypto index fund is $25,000. Since its inception in February 2021, Bitwise DeFi Crypto Index Fund has declined in worth by 81%.

What are Crypto Index Funds?

Crypto index funds are created to supply publicity to the digital asset market however in a diversified method. The primary idea is that as an alternative of investing in a number of cryptocurrencies immediately by means of an change, index funds provide entry to a basket of digital belongings by means of a single commerce.

The overarching good thing about that is that one of the best crypto index funds allow traders to realize publicity to the broader digital asset market. There are greater than a dozen crypto index funds on this area – eight of which we now have mentioned on this web page. Every crypto index fund may have its personal technique and objectives.

For instance, some index funds goal the highest 10 cryptocurrencies by market capitalization. Whereas others may concentrate on a particular area of interest space of the crypto area – resembling DeFi. The important thing metric to search for when selecting one of the best cryptocurrency index fund is the weighting system utilized. This refers back to the share that every particular person cryptocurrency contributed to the index.

The important thing difficulty on this regard is that the majority crypto index funds give desire based mostly on market capitalization. Because of this oftentimes, the overwhelming majority of the portfolio will likely be weighted in direction of Bitcoin and Ethereum. In truth, a number of of the funds mentioned at the moment weight greater than 90% of all the portfolio simply to those two cryptocurrencies.

In consequence, this does not actually provide traders a lot in the best way of diversification. Quite the opposite, the investor is basically allocating the overwhelming majority of their funds to Bitcoin and Ethereum, with the stability cut up loosely throughout different cryptocurrencies. Furthermore, expense rations are sometimes costly, with the likes of Bitwise charging 2.5% yearly.

Why Put money into Crypto Index Funds?

Nonetheless not sure whether or not crypto index funds are appropriate?

On this part, we’ll focus on a number of the primary concerns to make earlier than continuing.

Diversification

Maybe the primary purpose why some traders flip to crypto index funds is that it gives prompt diversification.

As we now have famous all through this information, index funds will observe a basket of various digital belongings, Because of this by way of a single funding, publicity to each cryptocurrency might be achieved.

The important thing difficulty is that many crypto index funds are closely weighted to Bitcoin and Ethereum. Because of this the portfolio will not be anyplace close to as diversified because it could possibly be.

Passive

One other good thing about investing in a crypto index fund is that the method is solely passive. After the preliminary funding is made, the supplier will routinely rebalance and reweight the crypto index fund based mostly by itself programs and targets.

For instance, some crypto index funds will rebalance the portfolio each month. This can normally readjust the share contributions that every particular person cryptocurrency is given.

- If a cryptocurrency has a big market capitalization when in comparison with the earlier month, then it is going to be given a better share.

- And equally, if the cryptocurrency has declined in worth, it’s going to possible be given a smaller share.

There may be additionally each likelihood that the rebalancing course of will end in a brand new crypto asset being added to the index fund.

As an example, let’s suppose that Solana is the tenth holding within the fund, which relies on market capitalization. If within the following month Solana has been changed by Polygon on the tenth spot, then the crypto index fund will possible make the swap.

Conventional Funding Course of

Traders which can be used to conventional monetary devices resembling shares and ETFs will usually want a crypto index fund over investing immediately.

It’s because many traders are hesitant about utilizing crypto exchanges – owing to the numerous scandals regarding hacks.

Then there may be the problem of safeguarding the bought cryptocurrencies in a personal pockets which, once more, might be intimidating for traders with out expertise on this area.

As an alternative, by choosing a crypto index fund, traders can allocate funds by way of conventional channels. This implies investing within the fund by means of a good ETF supplier, by way of an SEC-regulated brokerage.

Crypto Presales vs Crypto Index Funds – Which is Greatest?

Crypto index funds can symbolize a viable funding product when the broader markets are bullish. In spite of everything, the crypto trade usually strikes in tandem – particularly within the case of large-cap cash. In different phrases, when Bitcoin does effectively, so do different top-10 cryptocurrencies.

Nevertheless, the very fact of the matter is that for almost 12 months, the cryptocurrency enviornment has been embroiled in a bear market. And as such, most cryptocurrencies have misplaced at the least 70% from earlier highs – generally extra.

In consequence, crypto index funds are dropping vital sums of cash for his or her traders. As compared, all through the present bear market, many crypto presales have gone on to generate unprecedented returns. Simply two examples in 2022 embrace Fortunate Block and Tamadoge – which after their respective presales generated development of 60x, and 20x respectively.

The best upcoming ICOs as of writing are Sprint 2 Commerce and IMPT. The previous is providing its D2T tokens at simply $0.05 and the presale has already raised over $4 million. The D2T token will gas the Sprint 2 Commerce analytics dashboard – which is ready to launch in 2023.

IMPT can be value contemplating for these on the hunt for sizable presale features. This undertaking is constructing a carbon credit score buying and selling framework that can assist retail traders, companies, and authorities organizations. IMPT has already raised over $12 million in presale funding.

Conclusion

On the one hand, crypto index funds provide a seamless strategy to achieve publicity to a diversified basket of digital belongings by way of a single dealer. Furthermore, one of the best crypto index funds rebalance and reweight the portfolio on behalf of traders.

Nevertheless, crypto index funds are producing sizable losses at current – as per the broader bear market. As such, crypto presales like Sprint 2 Commerce provide a terrific various. Early traders may have entry to one of the best worth potential – which is why the Sprint 2 Commerce presale is promoting out quick.

FAQs

Are there crypto index funds?

Sure, there at the moment are greater than a dozen crypto index funds out there. Among the hottest embrace the Bitwise 10 Crypto Index Fund, Galaxy Crypto Index Fund, and the Bitwise DeFi Crypto Index Fund. Every of the aforementioned index funds completely tracks cryptocurrency costs. The Constancy Crypto Business and Digital Funds Index, alternatively, tracks a basket of crypto-centric shares.

What’s the finest crypto index fund?

Top-of-the-line crypto index funds by way of reputation is the Bitwise DeFi Crypto Index Fund. This fund invests in a basket of tasks which can be concerned within the development of decentralized finance – resembling Uniswap, Maker, and SushiSwap.

Does Constancy have a crypto index fund?

Sure, Constancy at the moment gives two crypto index funds which will enchantment to traders that search publicity to this rising trade. First, there may be the Constancy Crypto Business and Digital Funds Index – which tracks crypto-centric shares like Coinbase and Block. Then there may be the Constancy Metaverse ETF. This fund tracks shares which can be loosely concerned within the metaverse – resembling Tencent, Digital Arts, Netease, and Nintendo.

Is there a Vanguard crypto index fund?

In contrast to main competitor Constancy, Vanguard doesn’t at the moment provide an index fund for crypto. Whether or not or not there will likely be a Vanguard Cryptocurrency index fund in time for the subsequent bull run stays to be seen.

No comments:

Post a Comment